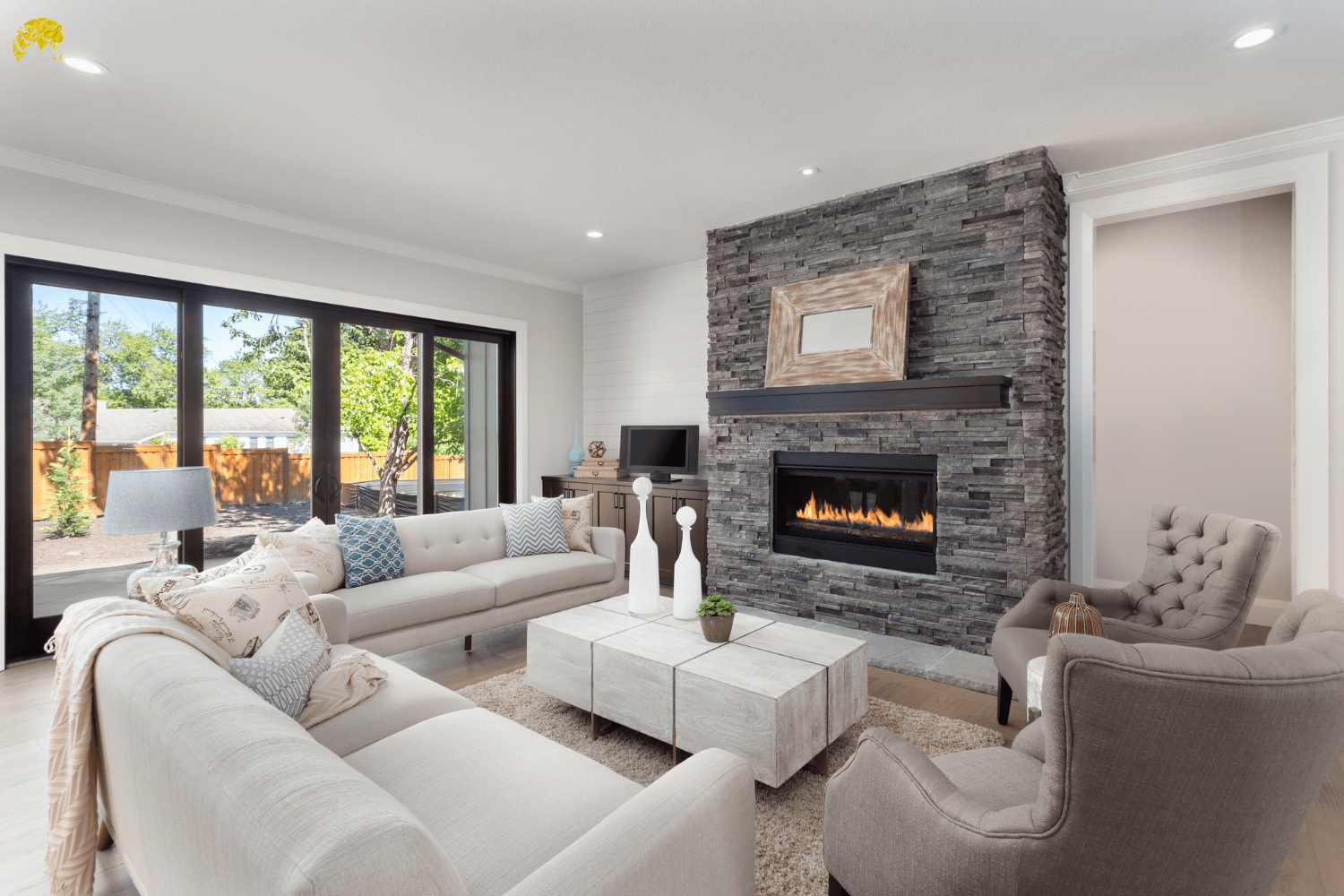

The real estate market in India is experiencing a significant upswing in the demand for larger apartments, particularly in the luxury housing segment. This surge can be attributed to the changing preferences of buyers who are seeking premium and more spacious homes. Real estate developers are capitalizing on this trend and witnessing higher realizations from the sale of luxury properties.

Rising Demand for Larger Apartments

According to experts, the preference for larger and premium homes has resulted in increased realizations for developers. Many buyers are eager to upgrade to more spacious apartments, which has fueled the demand for such properties. A recent report by Anarock revealed that the number of unsold luxury units priced above Rs 2.5 crore decreased by 24 percent, from 20,480 units in the previous year to 15,520 units by the end of March. In March 2019, the unsold stock stood at approximately 23,130 units.

Growing Market Share of Large Developers

Large listed real estate developers have witnessed a substantial boost in sales and market share. In terms of value, sales by these developers increased by nearly 50 percent in FY23, with the area sold witnessing a growth of around 20 percent. As a result, their market share is projected to reach approximately 30 percent in FY24, a significant rise from the 16-17 percent recorded in FY20. This growth can be attributed to the liquidation of inventory, robust collections, and reduced debt, which have improved the credit risk profiles of these developers.

Positive Outlook for Large Developers

Pranav Shandil, an associate director at Crisil Ratings, stated that large developers have experienced improved leverage and credit risk profiles due to healthy sales growth and debt reduction in the past two fiscal years. It is expected that their debt-to-total assets ratio will decrease to around 20 percent by March 2024, compared to approximately 45 percent at the beginning of the pandemic.

Market Analysis by Crisil

Crisil conducted a study on 11 large and listed developers as well as 76 small and mid-sized residential developers, which accounted for 35 percent of residential sales in India. The study encompassed six regions/cities, namely the Mumbai Metropolitan Region (MMR), National Capital Region (NCR), Bengaluru, Pune, Kolkata, and Hyderabad.

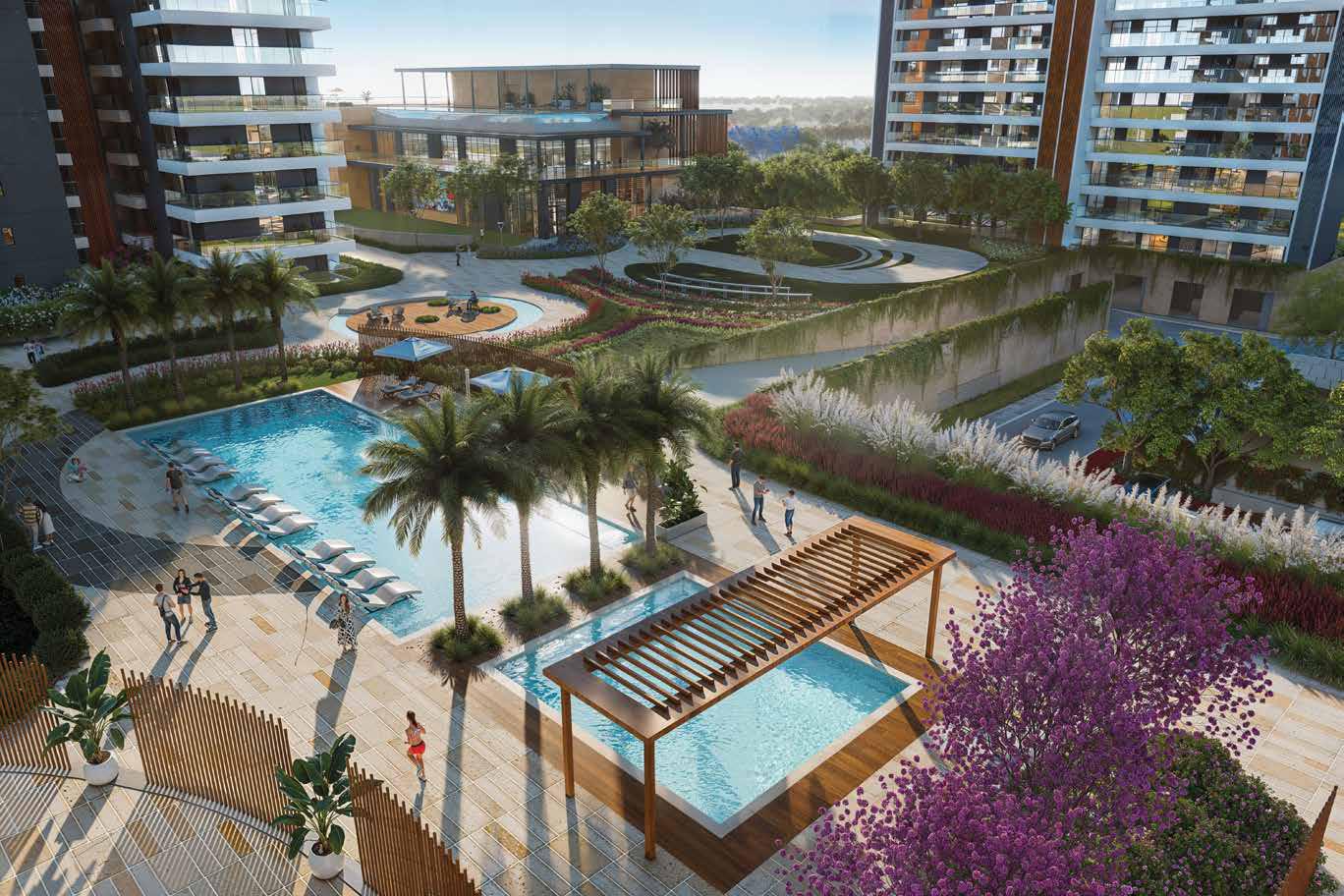

Shift in Consumer Preferences

Aniket Dani, the director of Crisil Market Intelligence and Analytics, highlighted the shift in consumer preferences towards larger configurations in premium housing projects after the emergence of hybrid work culture during the pandemic. Established developers have aligned their new launches accordingly, catering to this trend of demand for premium properties.

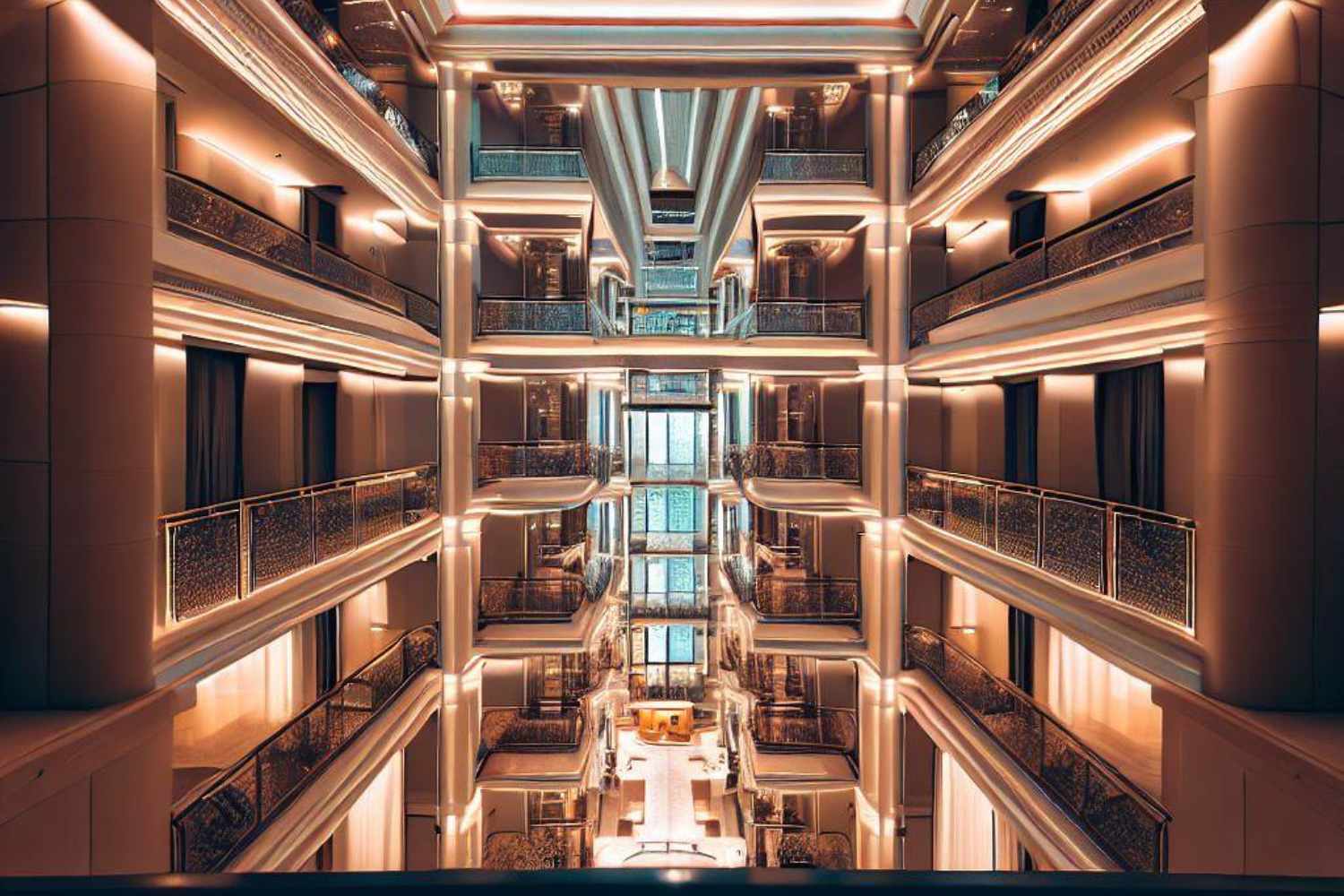

Luxury Projects and Margins

Pankaj Kapoor from Liases Foras mentioned that out of the 63 listed real estate companies, five to ten A-grade firms are expected to launch luxury projects due to their favorable profit margins. Over time, the luxury housing segment has witnessed a healthy offtake, making it an attractive market for developers. Conventional projects typically command a margin of 18 percent, while premium projects can achieve margins ranging from 28 to 30 percent.

Influence of Developers on Luxury Home Supply

Vivek Rathi, the director of research at Knight Frank, emphasized that luxury home supply is primarily influenced by real estate developers and demand. This trend has gained momentum due to renewed interest in homeownership. Developers are successfully meeting the demand for luxury properties, ensuring both high volumes and price growth in this segment.

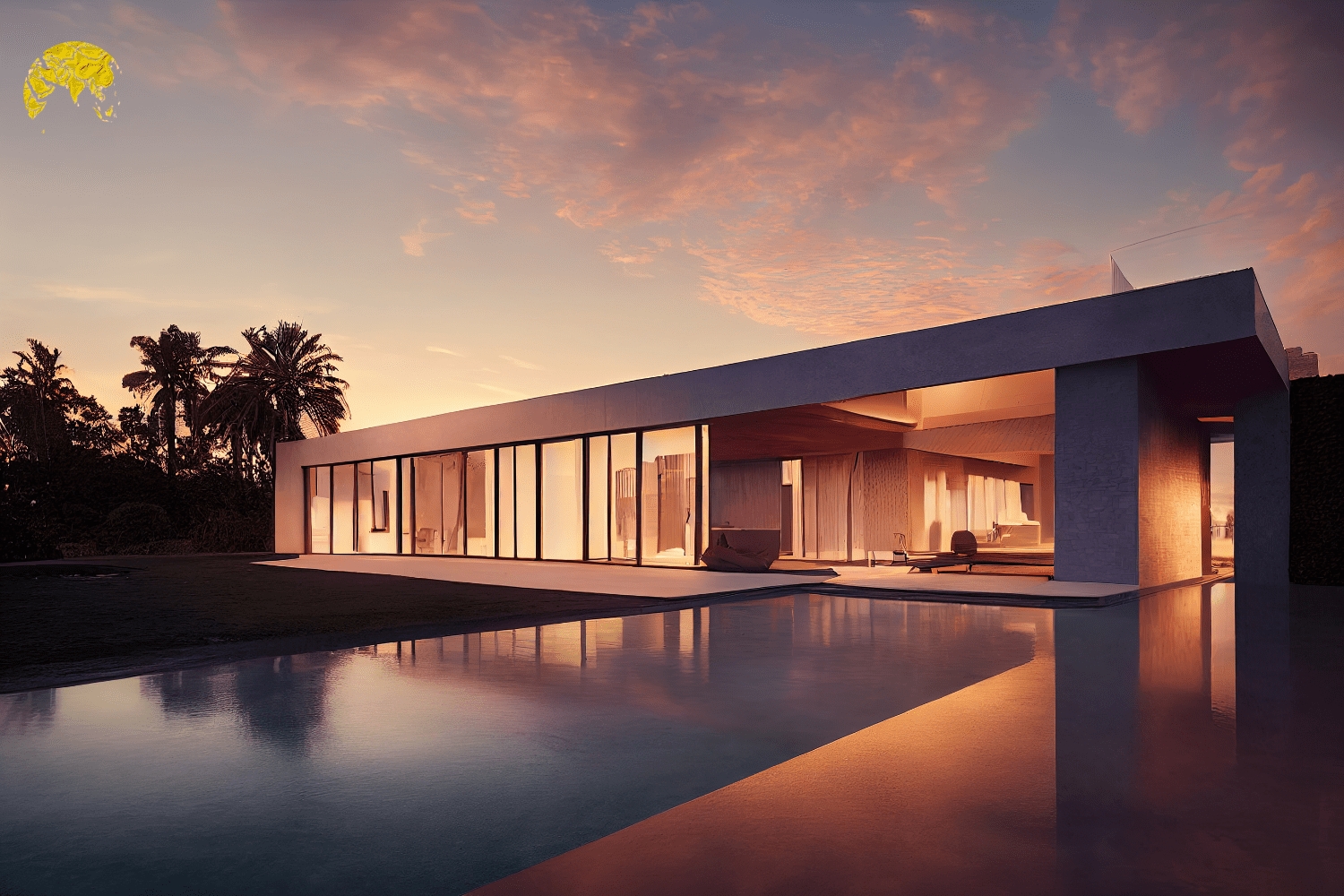

Luxury Housing Outstrips Mid-Range and Affordable Housing

Since the pandemic, there has been a consistent trend of luxury housing demand surpassing that of mid-range and affordable housing. Buyers in the luxury segment often skip the upgrading cycle and prefer to invest in the best available homes. The sales velocity of high-end offerings in the top seven cities is notably higher compared to other segments, indicating a strong demand for luxury properties.

Factors Affecting Luxury Project Development

Ritesh Mehta, a senior director at Jones Lang LaSalle, highlighted some key factors influencing luxury project development. In South Mumbai, luxury projects are mainly derived from the redevelopment of existing societies, and their members tend to prefer listed real estate firms. Luxury projects require significant capital investment and strong holding capacity, as most units are sold closer to their completion.

Success Stories of Real Estate Developers

Oberoi Realty, for instance, achieved Q4 sales bookings worth Rs 670 crore, with the 360 West Worli project contributing Rs 230 crore. Additionally, DLF recorded record FY23 bookings of Rs 15,100 crore, driven by the exceptional response to the Arbour residential project in Gurugram, which accounted for Rs 8,000 crore of the bookings. DLF has also expanded its launch pipeline and aims to achieve bookings of Rs 11,000 crore-12,000 crore in FY24E.

Future Prospects for the Luxury Segment

Macrotech Developers recently reported that its Malabar luxury project crossed the sales mark of Rs 1,000 crore. Furthermore, the Rustomjee Group plans to launch seven projects, including two luxury segments with a price bracket of Rs 10 crore-plus. These examples highlight the positive outlook for the luxury housing market in India.

Conclusion

The post-pandemic period has witnessed a significant surge in the demand for larger apartments, particularly in the luxury housing segment. Real estate developers have capitalized on this trend, with higher realizations from the sale of premium properties. The market share of large developers has also increased substantially, driven by improved credit risk profiles and sales growth. With the changing preferences of buyers and the strong performance of luxury housing, the market for larger apartments is expected to continue its upward trajectory in the coming years. Opulnz Abode strongly recommend all the investors and end users to buy luxury real estate.

https://opulnzabode.com/ Source: https://www.moneycontrol.com/news/business/real-estate/heres-how-you-should-navigate-the-luxury-real-estate-market-10889961.html