Introduction

In today’s volatile financial landscape, investors are constantly seeking the most profitable avenues to grow their wealth. With the stock market hitting record highs, many individuals are pondering the age-old question: Which investment option is better – Mutual Funds, Gold, or Real Estate? In this comprehensive guide, we delve into the intricacies of each asset class, analyzing their performance, risks, and potential returns. By examining the pros and cons, we aim to equip you with the knowledge necessary to make an informed investment decision.

Mutual Funds: A Diversified Approach to Wealth Creation

Mutual funds offer a diversified investment vehicle that pools money from numerous investors to invest in a professionally managed portfolio of stocks, bonds, or other securities. Here are some key points to consider:

- Risk and Return: Mutual funds provide an opportunity for investors to gain exposure to a wide range of asset classes, reducing risk through diversification. Returns are linked to the performance of the underlying securities.

- Professional Management: Fund managers possess expertise in analyzing and selecting securities, aiming to outperform the market and generate favourable returns for investors.

- Liquidity and Accessibility: Mutual funds offer liquidity, allowing investors to buy or sell units at the prevailing Net Asset Value (NAV) on any business day. They are also accessible to both seasoned and novice investors with varying investment amounts.

- Transparency and Regulation: Mutual funds are subject to stringent regulatory oversight, ensuring transparency in operations and investor protection.

Gold: A Timeless Store of Value

Gold has long been regarded as a safe haven and a hedge against inflation. Here’s what you should know about investing in gold:

- Historical Performance: Gold has demonstrated its ability to retain value over time, providing a hedge against economic uncertainties and market volatility.

- Diversification Benefits: By including gold in your investment portfolio, you can diversify risk and potentially offset losses incurred by other asset classes during market downturns.

- Inflation Protection: Gold’s value tends to rise during periods of inflation, making it an attractive option for preserving purchasing power.

- Liquidity and Tangibility: Gold is a highly liquid asset that can be easily converted into cash. It also holds intrinsic value as a tangible asset, offering a sense of security to investors.

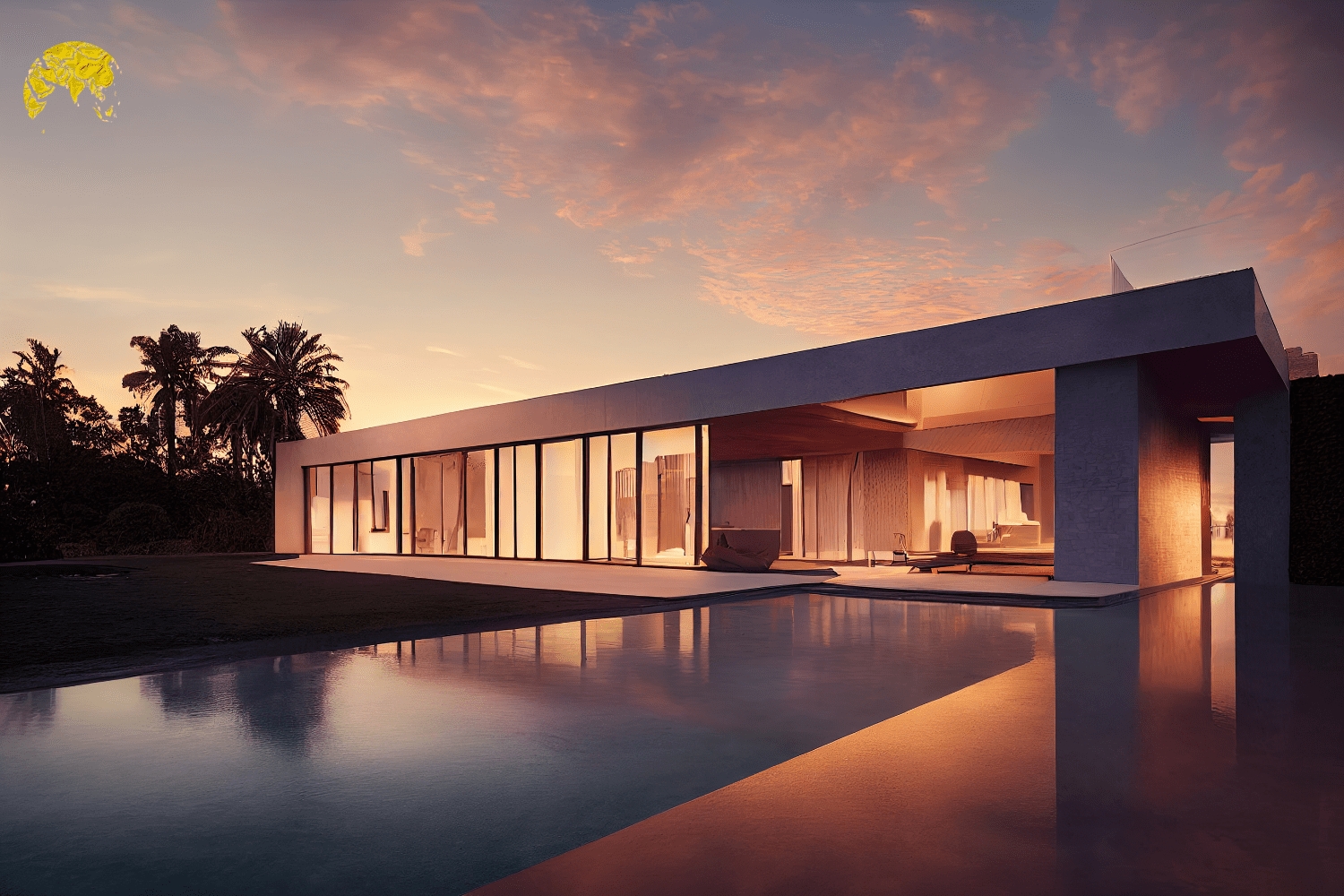

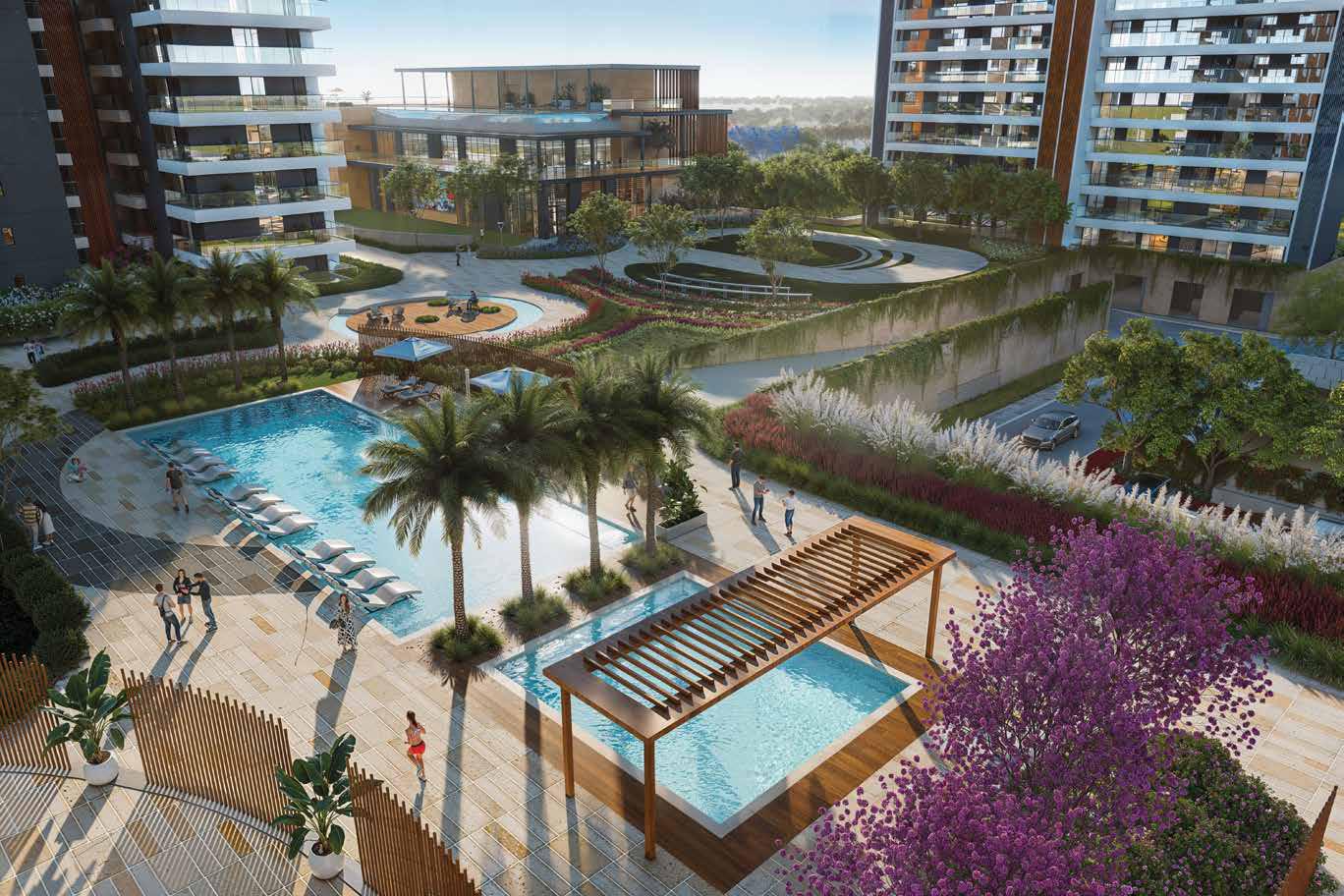

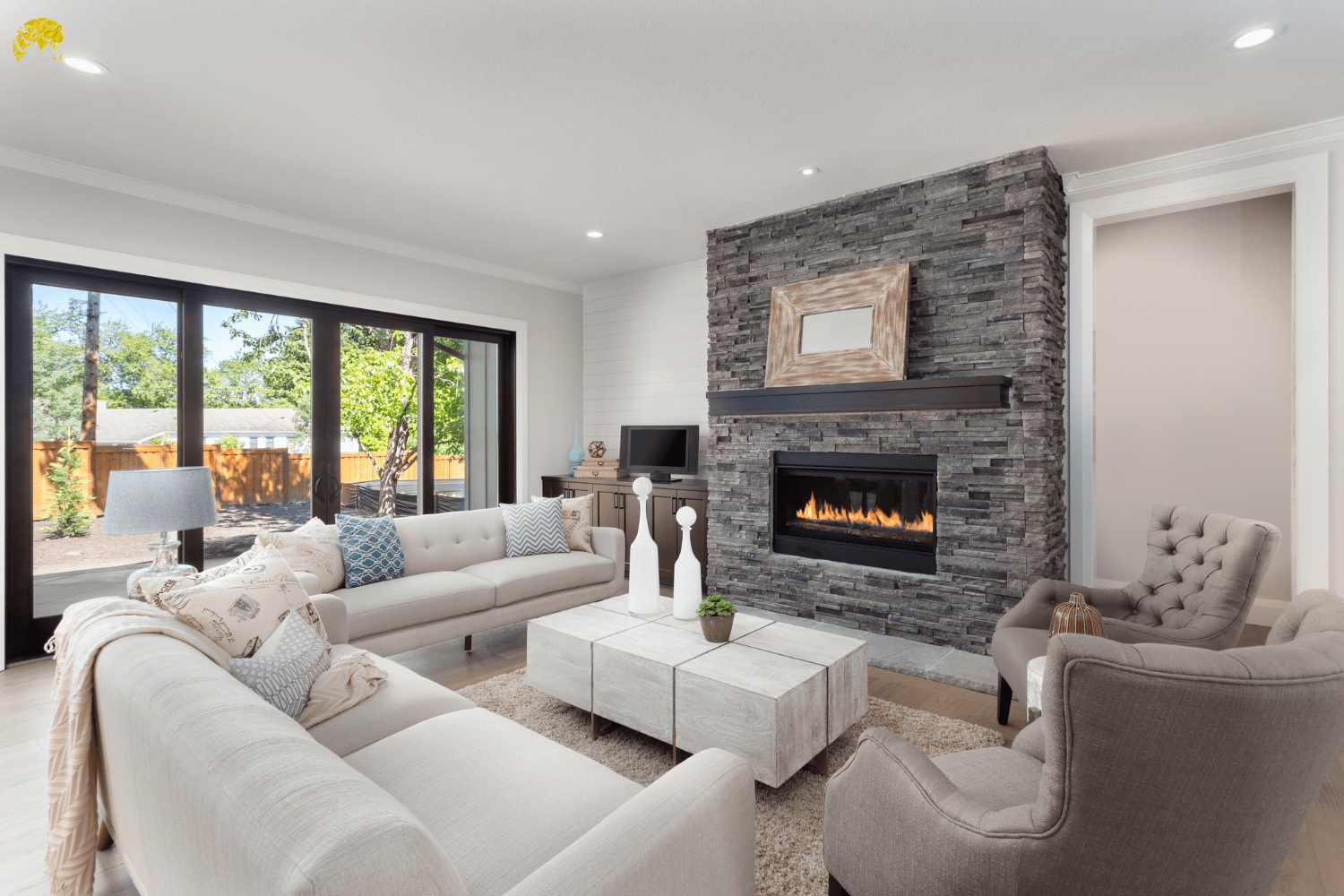

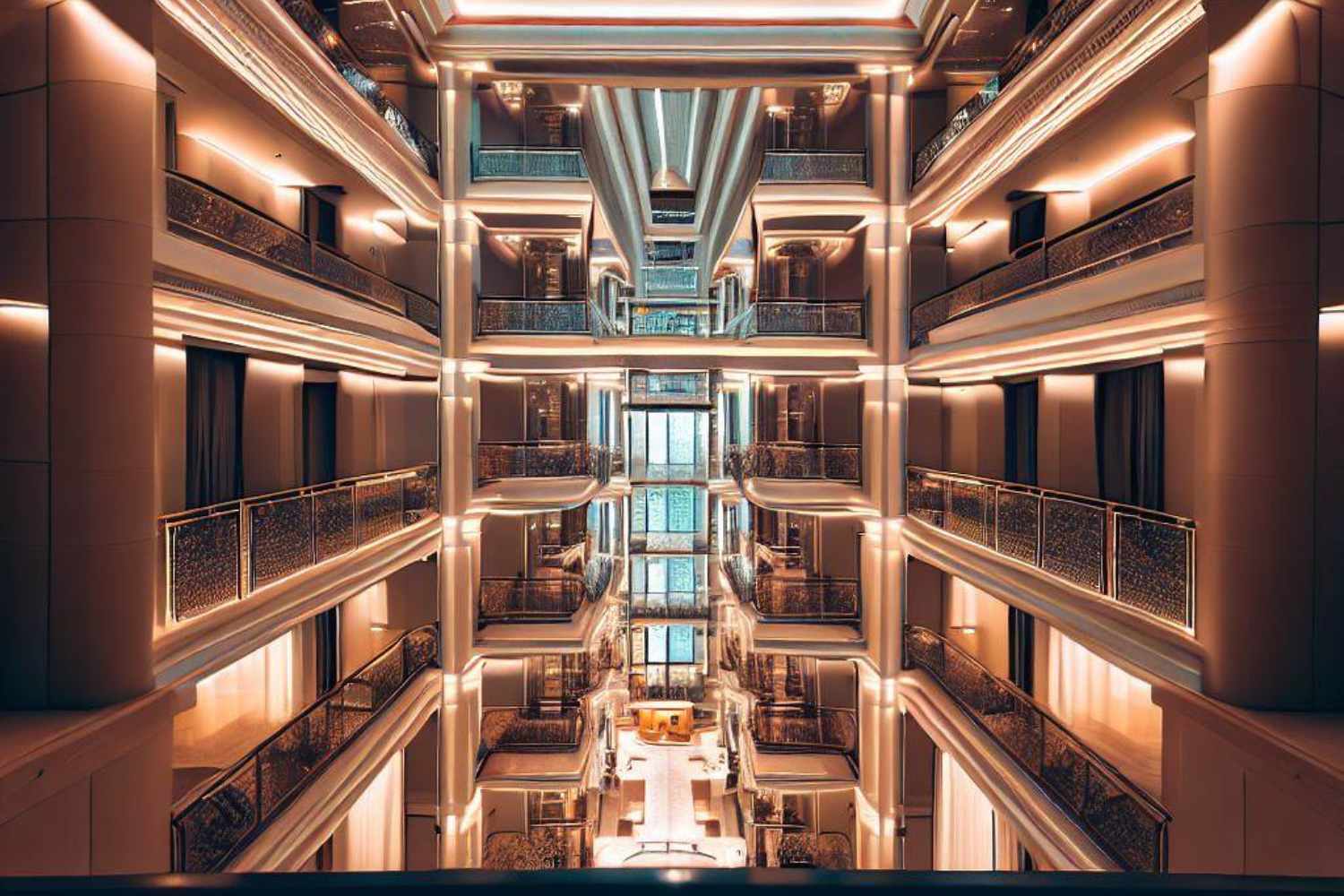

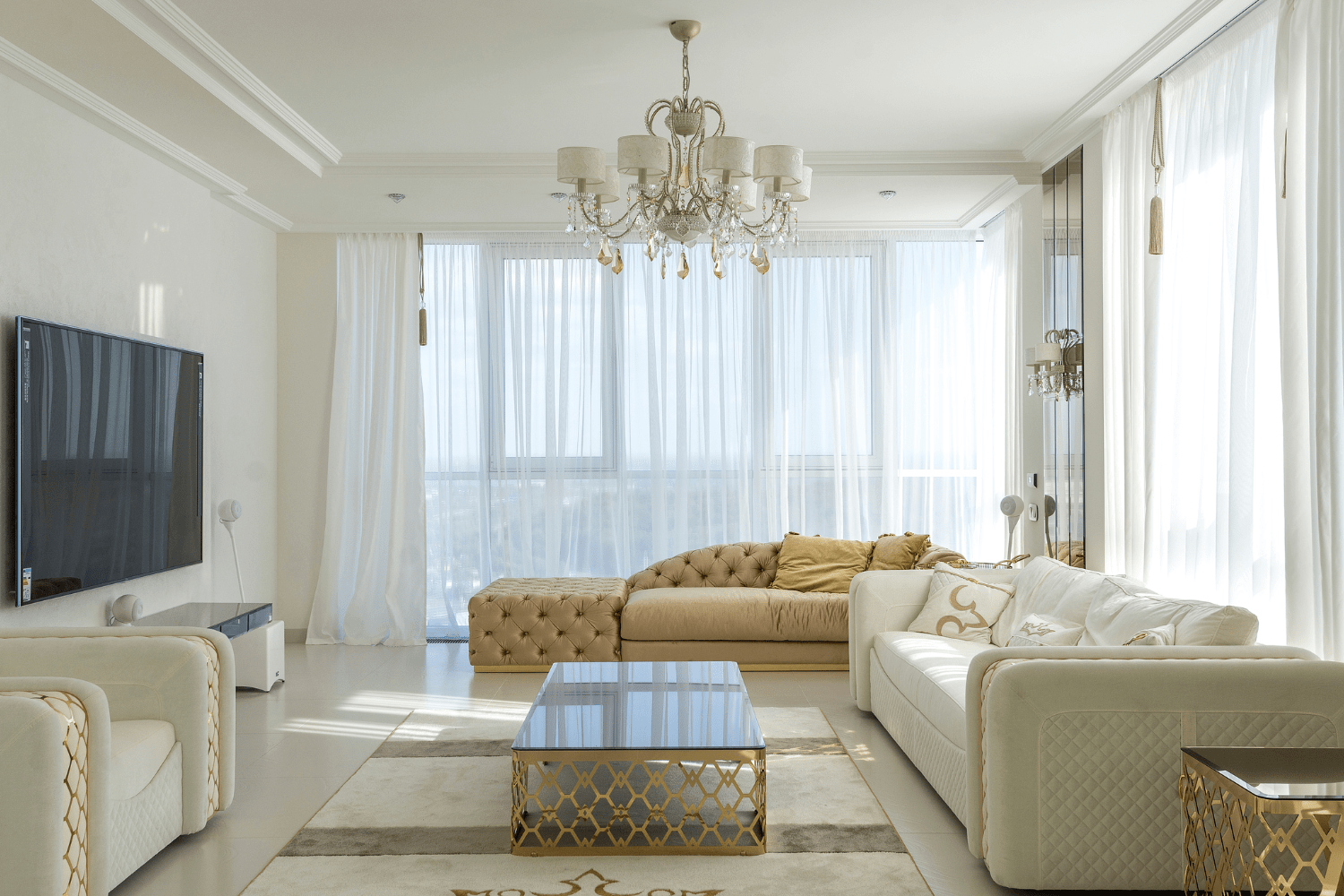

Real Estate: Building Wealth through Property Ownership

Investing in real estate involves purchasing and owning physical properties or real estate investment trusts (REITs). Here are the key advantages of real estate investments:

- Income Generation: Real estate properties can generate a steady stream of rental income, providing investors with a passive income source.

- Appreciation Potential: Property values have historically increased over the long term, offering the potential for capital appreciation and wealth creation.

- Leverage and Tax Benefits: Real estate investments often allow investors to leverage their capital by borrowing funds, magnifying potential returns. Moreover, tax deductions on mortgage interest and depreciation can enhance overall investment profitability.

- Portfolio Diversification: Real estate investments can add diversification to an investment portfolio, as their performance is typically not closely correlated with traditional asset classes.

Conclusion

Choosing the most suitable investment option among Mutual Funds, Gold, and Real Estate depends on various factors such as risk tolerance, investment horizon, and financial goals. Each asset class presents distinct advantages and considerations that should be carefully evaluated before making a decision. Ultimately, a well-diversified portfolio that combines different investment options may offer the best opportunity for long-term wealth creation.

Remember, while this guide provides valuable insights into Mutual Funds, Gold, and Real Estate, it is important to conduct thorough research and seek professional financial advice to align your investment strategy with your specific circumstances and objectives.

Invest wisely and confidently in your journey towards financial prosperity with Opulnz Abode https://opulnzabode.com/