Team Opulnz Abode: 24-04-2024, 15:15: Read Time – 4.5mins

Discover the pivotal role of private equity in reshaping India’s real estate sector, amplifying investment opportunities, and driving growth. Explore emerging industries and innovative strategies for maximising returns in the dynamic real estate market.

Private Equity: Amplifying Investment Opportunities

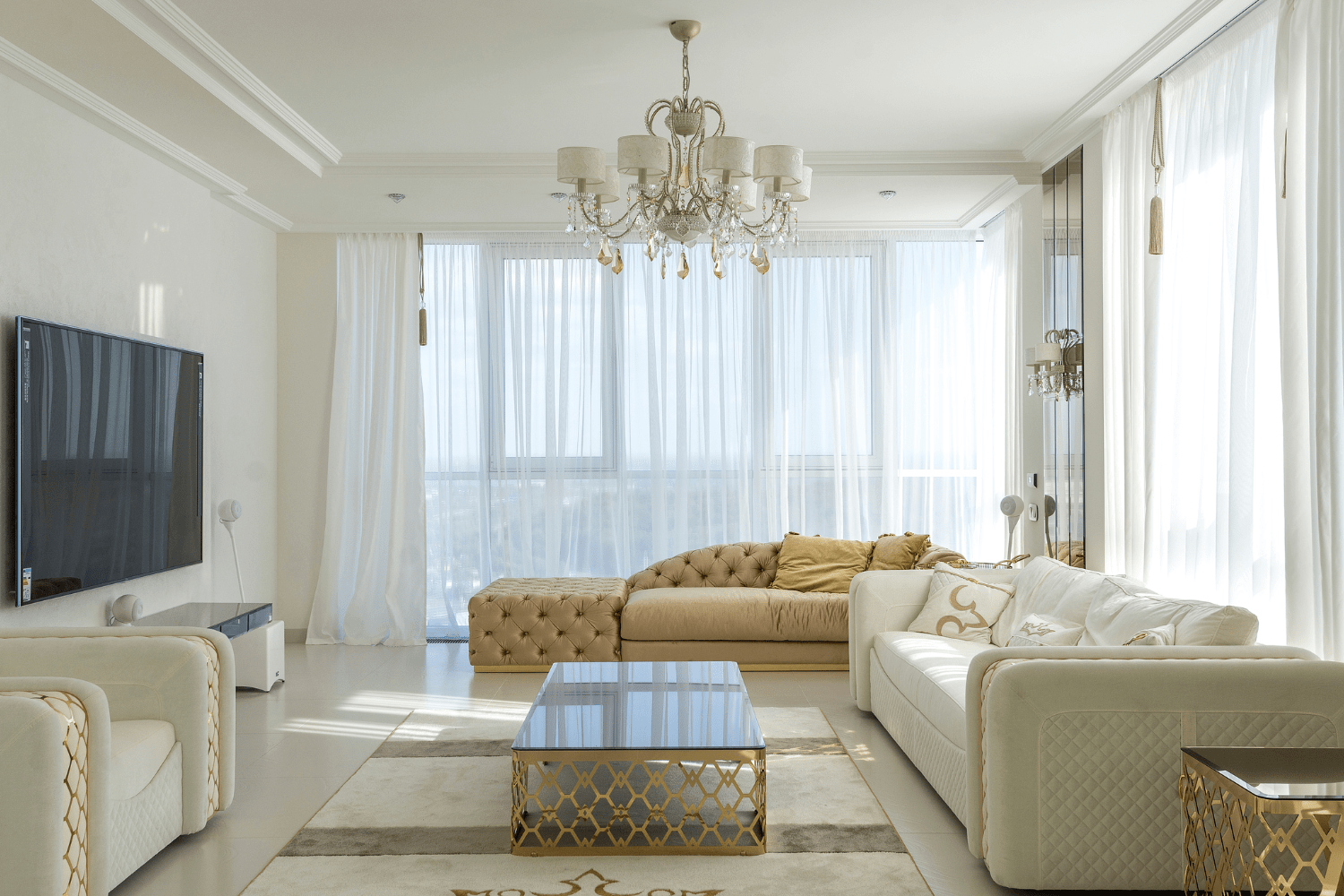

Private equity investment in India’s real estate sector is on the rise, driven by favourable market conditions, regulatory reforms, and the country’s robust economic fundamentals. As investors seek attractive returns and portfolio diversification, the real estate sector has emerged as a promising destination for private equity capital, offering the potential for high returns.

Favourable Market Dynamics

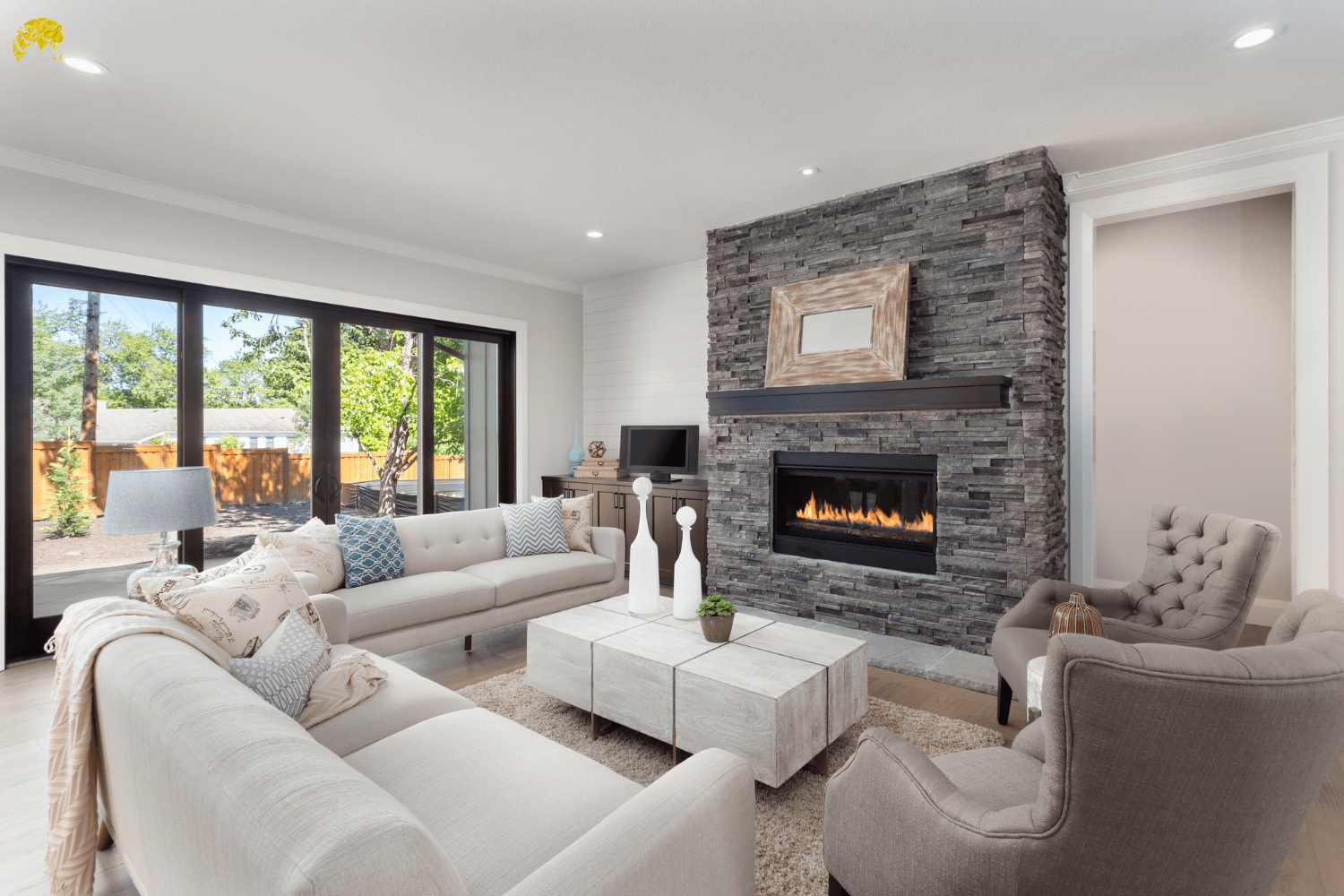

India’s real estate market offers attractive investment opportunities across asset classes, including residential, commercial, and industrial properties. With steady demand from end-users and investors alike, the sector has demonstrated resilience in market volatility and economic uncertainty. Additionally, regulatory reforms such as the Real Estate (Regulation and Development) Act (RERA) have enhanced transparency and investor confidence, further fuelling private equity investment in the sector.

Emerging Investment Avenues

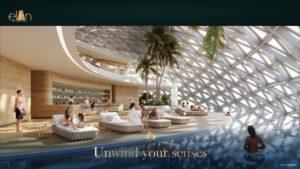

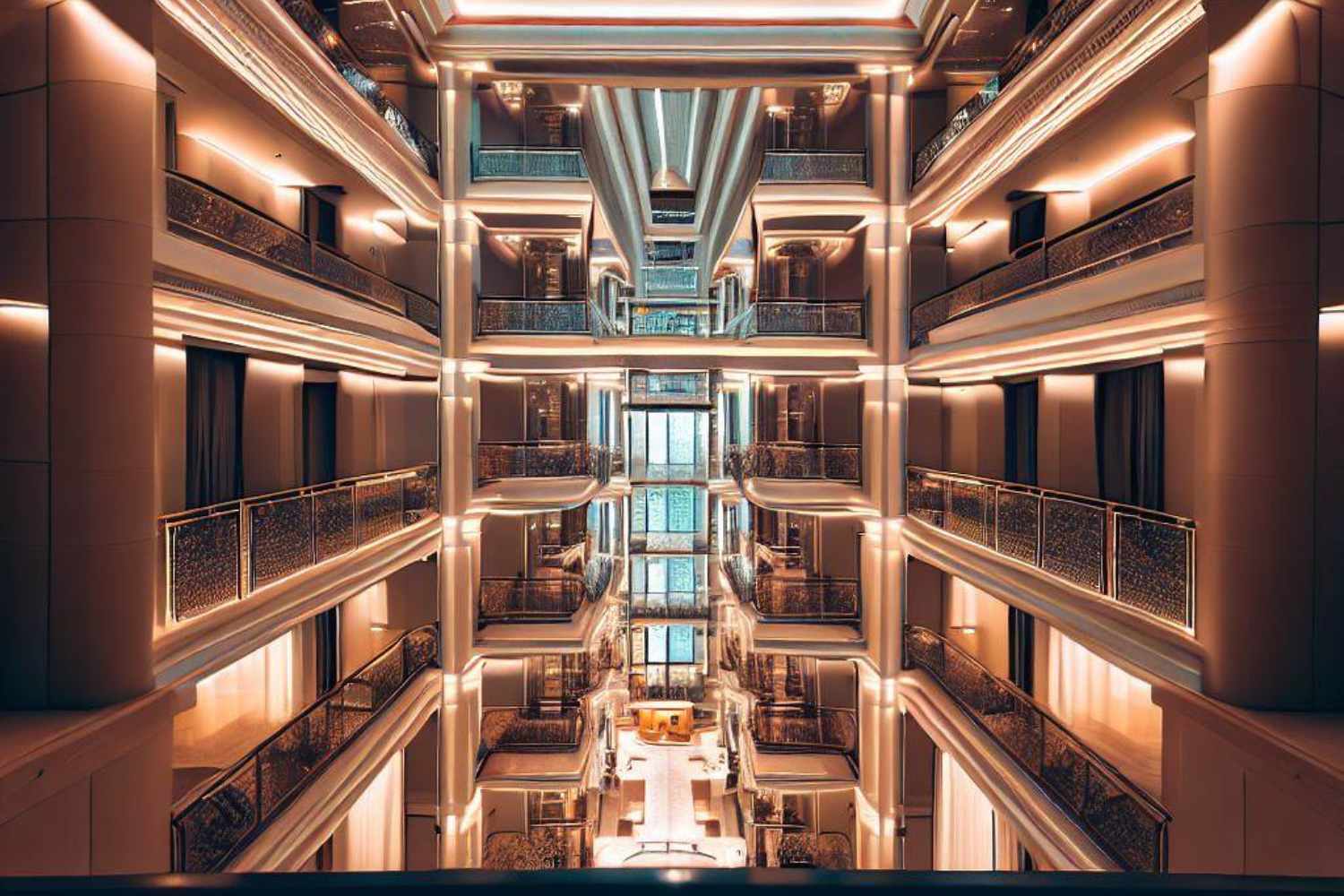

Emerging sectors such as data centres, healthcare, hospitality, co-living, and co-working spaces not only present promising avenues for private equity investors but also offer a clear direction for investment. These sectors are witnessing rapid growth and are poised to benefit from favourable demographic trends, urbanisation, and technological advancements. With increasing demand for specialised real estate assets, private equity firms actively explore opportunities to deploy capital and generate attractive returns.

Future Outlook

The outlook for private equity investment in India’s real estate sector remains positive, driven by solid fundamentals and favourable market dynamics. As the economy grows and urbanisation accelerates, the demand for real estate assets will remain robust, creating ample opportunities for private equity investors to capitalise on India’s growth story. Private equity firms can unlock value and drive sustainable growth in the real estate sector by focusing on emerging industries and adopting a disciplined investment approach.

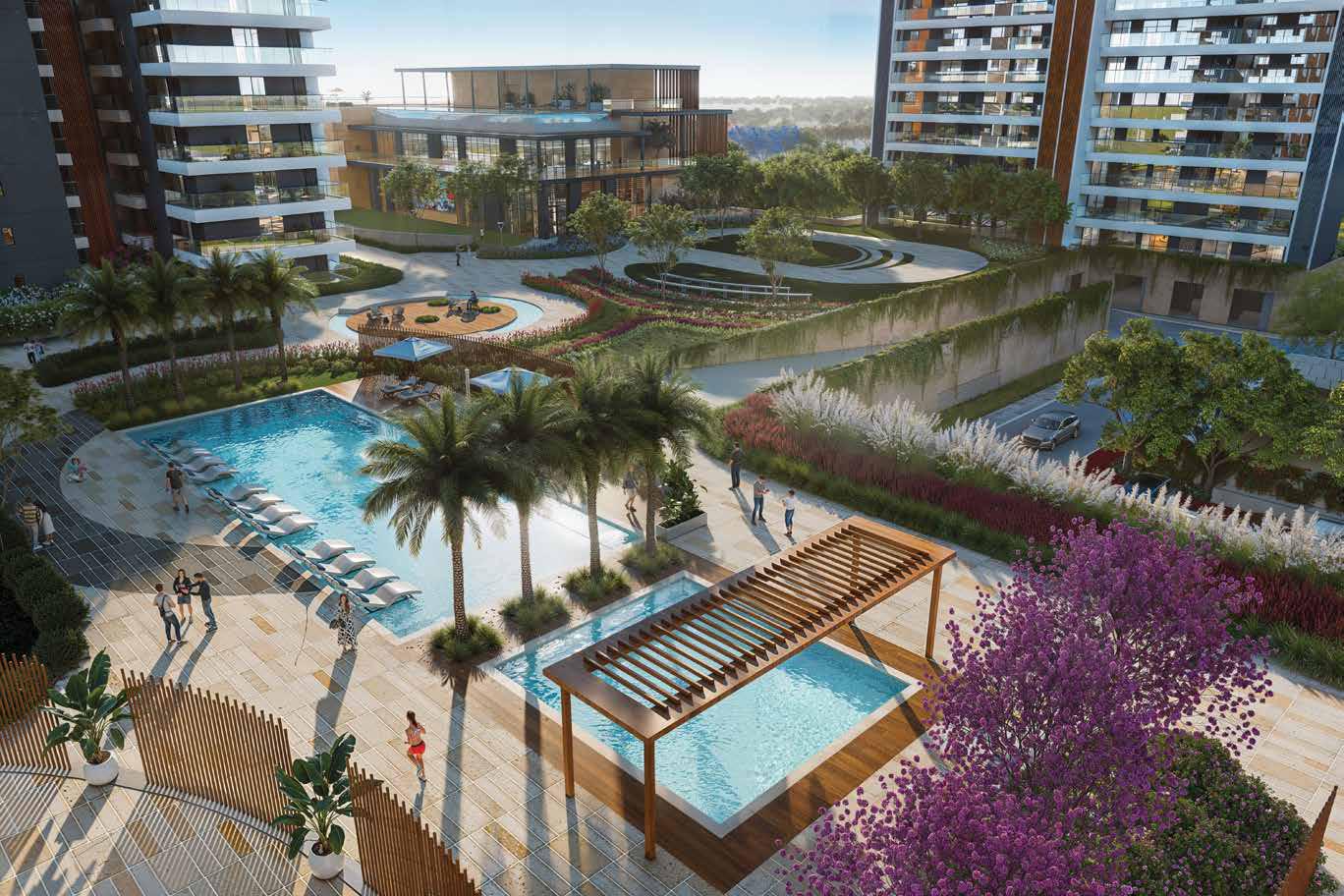

Upcoming Projects on Dwarka Expressway

Capitalise on Manpower: Bridging the Skill Gap

India’s real estate sector is poised for significant growth, demanding a skilled workforce to enhance sectoral efficiency. However, the industry needs more trained workers despite employing 70 million people, constituting 18% of the workforce. With 63% of the population in the working-age category, there’s abundant potential to enhance productivity and bridge the skill gap.

Strengthening Training Modules

It is essential to strengthen training modules in institutes as per industry requirements. By aligning educational curricula with the needs of the industry, aspiring professionals can acquire relevant skills and knowledge to succeed in the real estate market. Continuous training and upskilling programs can help existing workers adapt to changing industry trends and technologies.

Collaboration Between Academic Institutions and Private Employers

The importance of collaboration between academic institutions and private employers cannot be overstated in bridging the skill gap in the real estate sector. By fostering partnerships, educational institutions can gain insights into industry requirements and tailor their programs accordingly. Similarly, private employers can actively participate in curriculum development,

provide internships and on-the-job training opportunities, and recruit skilled graduates, creating a talent pipeline for the sector.

Encouraging Coursework and Certification with Professional Bodies

Encouraging coursework and certification with professional bodies can enhance the employability of individuals in the real estate sector. Professionals can demonstrate their expertise and competence to potential employers by obtaining industry-recognised certifications and accreditations. Furthermore, professional bodies play a vital role in setting industry standards, promoting best practices, and fostering continuous learning and development within the sector.

Urban Housing Requirement: Addressing the Housing Deficit

India’s housing deficit, exacerbated by rapid urbanisation, poses a significant challenge, particularly for lower-income groups. As property prices soar and borrowing costs remain high, millions of Indians cannot afford decent housing. Addressing this housing deficit requires a holistic approach, encompassing policy interventions, incentivising developers, and leveraging unused land resources.

Upcoming Projects on Golf Course Road

Rationalizing Stamp Duties

One of the critical barriers to homeownership in India is the high cost of property transactions, primarily due to stamp duties. Rationalising stamp duties can make homeownership more affordable, especially for first-time buyers and lower-income groups. By reducing the financial burden of property transactions, governments can stimulate housing demand and promote inclusive growth in the real estate sector.

Provision of Interest Rate Subsidies

Interest rate subsidies can make housing loans more accessible and affordable for low—and middle-income households. By reducing the cost of borrowing, governments can enable more individuals to purchase homes and address the housing deficit. Additionally, targeted subsidies for affordable housing projects can incentivise developers, including private equity firms, to focus on catering to the housing needs of marginalised communities, thereby playing a significant role in addressing the housing deficit.

Tapping into Unused PSU Lands

Public Sector Undertakings (PSUs) own vast tracts of land across the country, which can be leveraged to address the housing deficit. By unlocking the potential of unused PSU lands, governments can create affordable housing developments in strategic locations close to employment centres and urban amenities. This approach not only provides housing opportunities but also revitalises underutilised land assets, generating revenue for the government and stimulating economic activity.

Adoption of Technology: Pioneering Innovation

Technological advancements can revolutionise the real estate sector, streamlining processes, enhancing transparency, and improving efficiency. Technology-driven solutions are reshaping the industry’s operations from property search and transactions to construction and project management.

Upcoming Projects on Southern Periphery Road

Protech: Streamlining Operations

The emergence of Protech (Property Technology) has transformed various aspects of the real estate lifecycle, from marketing and sales to property management and maintenance. By leveraging technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and Building Information Modelling (BIM), Protech solutions streamline operations, automate routine tasks, and provide valuable insights to stakeholders.

Enhancing Customer Experience

Technology adoption in the real estate sector enhances the customer experience by offering innovative tools and platforms for property search, virtual tours, and digital transactions. Whether buying, selling, or renting property, consumers can access information, communicate with agents, and complete transactions seamlessly, reducing the time and effort involved in the process.

Driving Sustainable Development

In addition to improving operational efficiency, technology plays a crucial role in driving sustainable development in the real estate sector. Technology enables developers to design and construct sustainable buildings that minimise environmental impact and reduce carbon emissions from energy-efficient buildings and intelligent infrastructure to green construction materials and renewable energy solutions.

Sustainable Practices: Building for the Future

As India strives to achieve its climate goals and promote sustainable development, the real estate sector plays a crucial role in reducing carbon emissions and minimising environmental impact. Developers, including private equity firms, can contribute to this mission by adopting sustainable practices and green building standards, thereby creating healthier, more resilient communities and contributing to India’s overall sustainability objectives.

India Green Building Council (IGBC) Norms

Adopting India Green Building Council (IGBC) norms is instrumental in promoting sustainable construction practices and green building certification in India. By adhering to IGBC guidelines, developers can design and construct energy-efficient, water-saving, and environmentally friendly buildings, thereby reducing their carbon footprint and operating costs over the building’s lifecycle.

To be IGBC rate project on Dwarka Expressway

Net-Zero Carbon Buildings

Net-zero carbon buildings, which produce as much renewable energy as they consume, are gaining traction in India as developers prioritise sustainability and environmental stewardship. By integrating renewable energy sources such as solar panels, wind turbines, and geothermal systems, developers can create self-sufficient buildings in terms of energy consumption, reducing reliance on fossil fuels and mitigating climate change.

Circular Economy Principles

Embracing circular economy principles in the real estate sector involves minimising waste, maximising resource efficiency, and promoting the reuse and recycling of materials. By adopting strategies such as modular construction, adaptive reuse of existing buildings, and sustainable waste management practices, developers can reduce construction waste, conserve natural resources, and create more resilient built environments.

Conclusion: Embracing a Brighter Tomorrow

India’s real estate sector is poised for unprecedented growth, driven by demographic trends, urbanisation, and economic development. As the industry evolves, stakeholders must embrace sustainable practices, harness technology, and prioritise inclusivity to create vibrant, resilient communities for future generations. By working together and leveraging the opportunities presented by India’s real estate boom, we can build a brighter, more prosperous tomorrow for all.

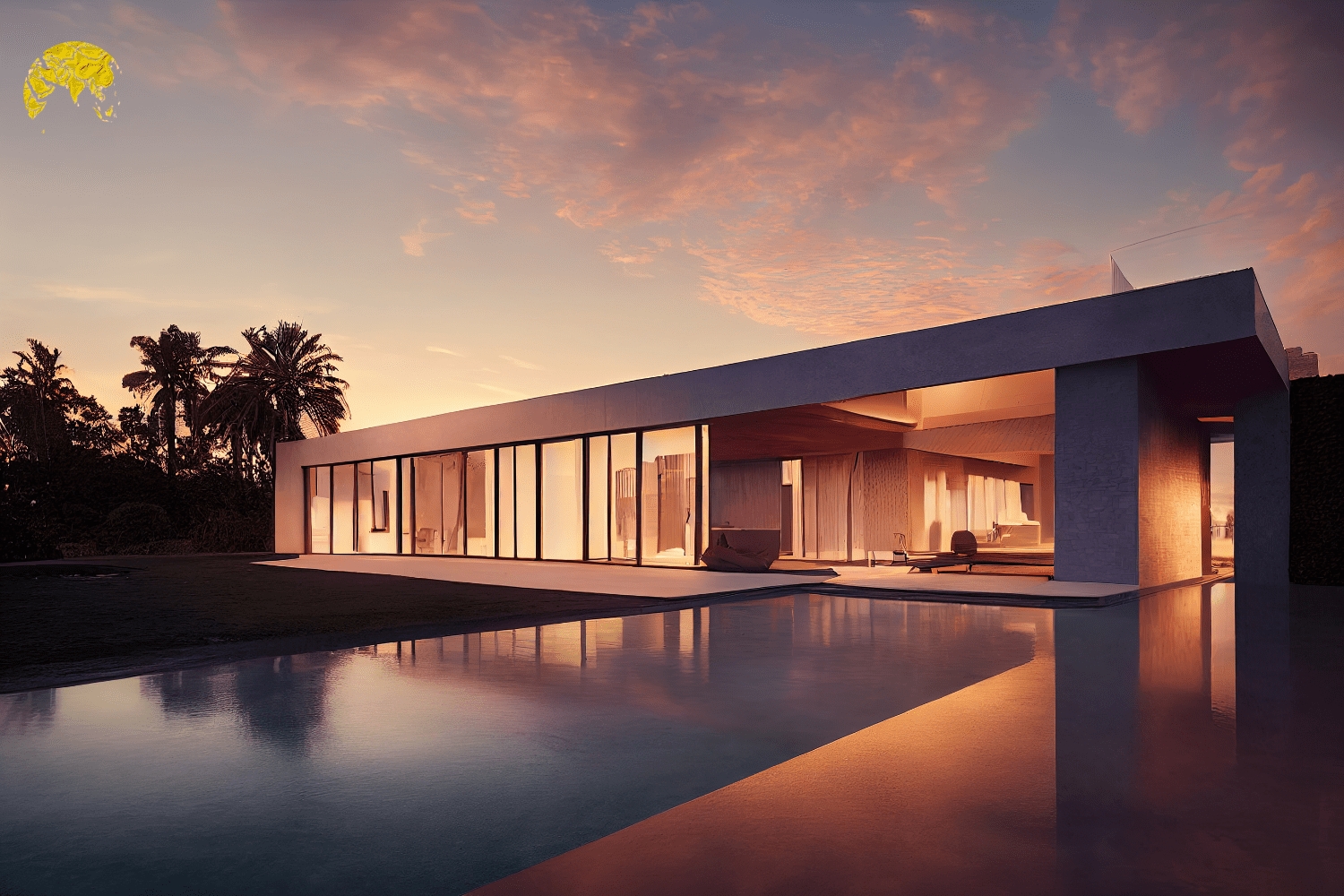

Branded Residences Project on Dwarka Expressway

Source: Source: https://www.news18.com/business/investment-goldmine-indian-real-estate-expected-to-reach-1-5-trillion-by-2034-report-8849015.html