Southern Indian states, prominently Bengaluru, emerge as leaders in the senior living housing segment, commanding a significant 62% share. Following suit, the north zone captures 25% of the senior living market share. In comparison, the central zone contributes 13%, as outlined in the recent report by CBRE titled ‘Golden Opportunities from the Silver Economy – Analyzing the Future of Senior Care in India’.

Pan-India Perspective: Rapid Evolution of Senior Care Landscape

The senior care landscape in India is rapidly evolving, with approximately 18,000 units spread across the country. Notably, southern India is at the forefront of this evolution, contributing around 62% to the overall supply in organized senior living and care segments, a trend that should capture the interest of real estate developers.

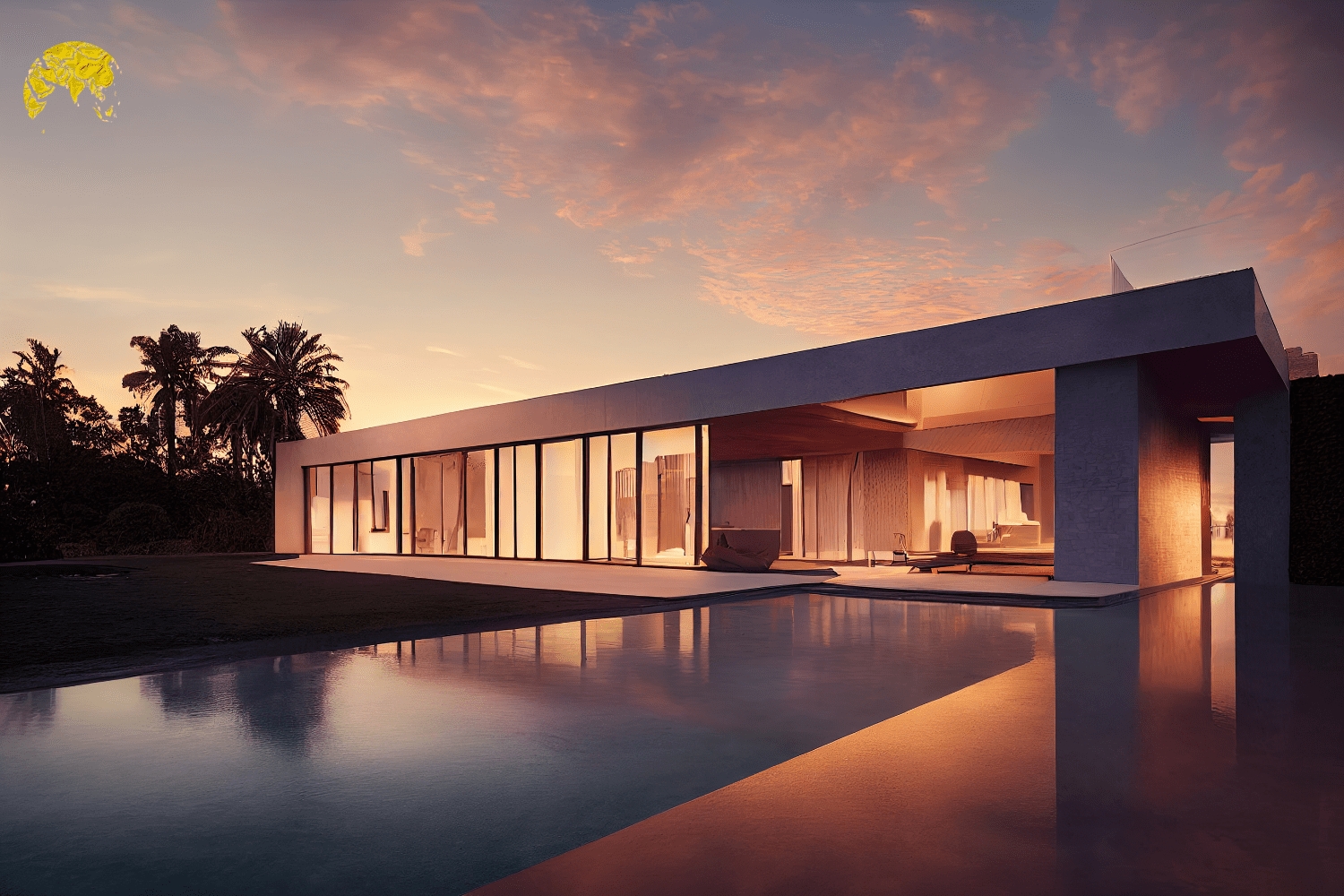

Upcoming Senior Living Project in Bangalore

Concentration of Major Players and Future Expansion

Major players in the senior care segment are strategically focusing their future expansion efforts on key cities, including Chennai, Bengaluru, Hyderabad, Coimbatore, Pune, and the National Capital Region (NCR), providing a clear roadmap for healthcare professionals and guiding their investment decisions.

Regional Dynamics: Beyond Southern India

While southern India takes the lead, other significant zones include the north zone encompassing Haryana, Rajasthan, Uttarakhand, Uttar Pradesh, and Himachal Pradesh, securing a 25% market share of senior living and care units. Additionally, the central zone comprising Maharashtra, Gujarat, West Bengal, and Madhya Pradesh contributes 13% to the senior living segment.

Challenges in Northern and Western Regions

The northern and western regions, including cities like Delhi-NCR, Pune, and Jaipur, have a sparse distribution of senior care players, indicating a need for expansion and investment in these areas.

Max Antara Pioneers in Senior Living

Target Population and Market Penetration

The target population for senior living primarily focuses on individuals aged 60 and above. India’s current penetration rate for senior living stands at less than 1%, contrasting sharply with countries like the UK (11%), the US (over 6%), and Australia (approximately 6.7%).

Driving Factors Behind the Rise in Senior Living Segment

The surge in the senior living segment is propelled by various factors, notably the rise in nuclear families. Currently, 20% of the elderly population live alone or with only one spouse, a trend expected to continue as the old-age dependency ratio is expected to rise from 16% in 2020 to 34% by 2050.

Concentration of Senior Care Players in Southern Tier-I and II Cities

The senior care segment witnesses a concentration of significant players in tier-I and II cities of southern India, notably Chennai, Coimbatore, and Bengaluru. These cities serve as focal points for the current operations and future expansion plans of key players in the industry. Looking ahead, significant players are strategically targeting cities such as Chennai, Bengaluru, Hyderabad, Coimbatore, Pune, and the National Capital Region (NCR) for further expansion of senior care units.

Sparse Distribution in Northern and Western Regions

The distribution of senior care players remains sparse in India’s northern and western regions. As indicated by the report, cities like Delhi-NCR, Pune, and Jaipur witness a limited presence of senior care facilities. They highlight the need for increased investment and expansion efforts in these regions to cater to the growing demand for senior care services.

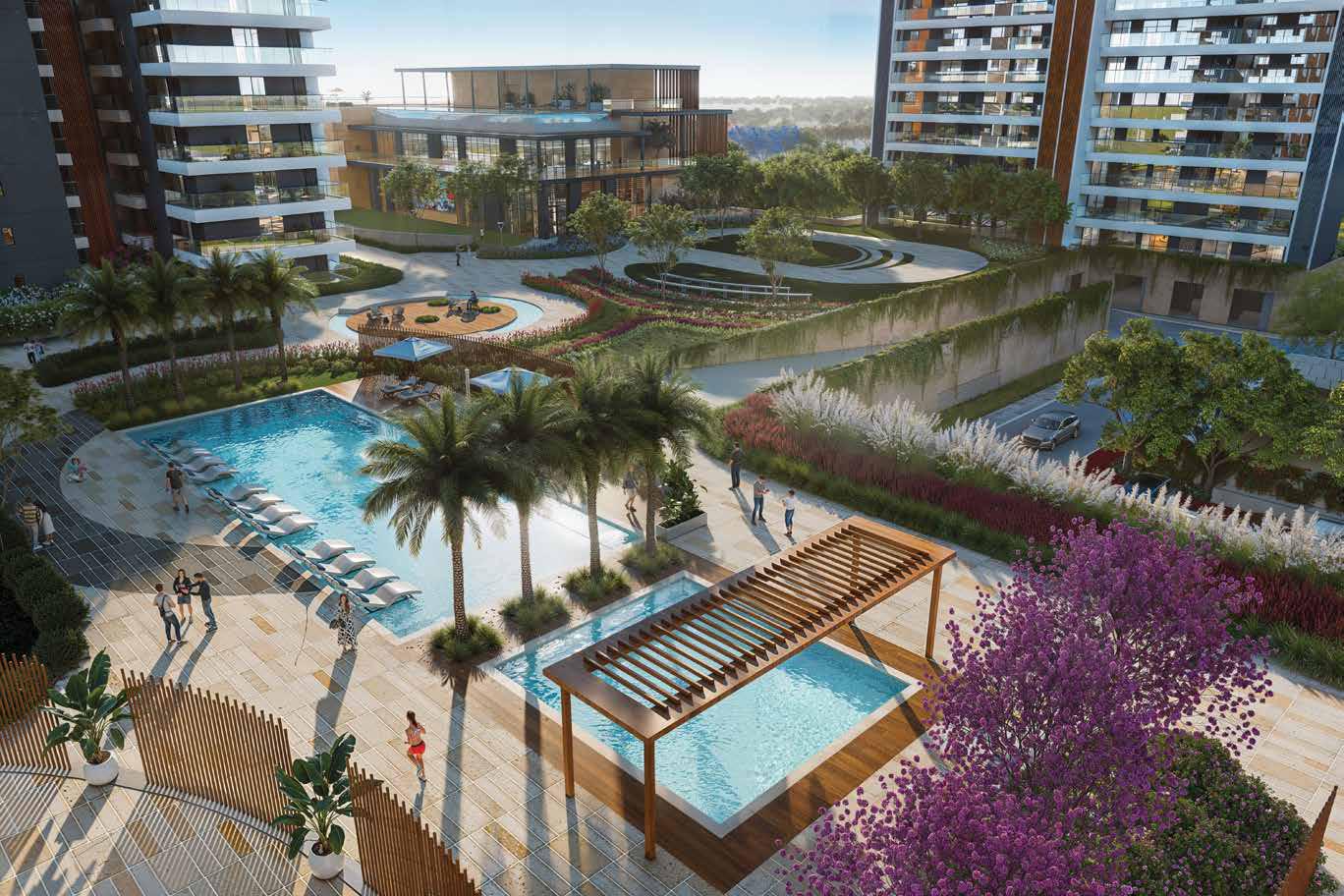

Upcoming Senior Living Project isn Gurugram

Factors Contributing to Southern States’ Dominance

The dominance of southern states is attributed to several factors, including higher affordability levels and a growing acceptance of nuclear family structures. Additionally, prominent healthcare facilities in southern states facilitate access to tertiary healthcare and foster awareness of geriatric care services. The availability of well-trained staff, aligned with the region’s focus on the healthcare sector, further enhances the quality of senior care.

Future Projections and Expansion Targets

The estimated target for senior living facilities in 2024 stands at around 1 million and is projected to surge to a staggering 2.5 million over the next decade. This exponential growth potential, coupled with the current demand for senior living, presents a promising investment opportunity. Currently, India hosts approximately 150 million elderly individuals, a number that is expected to rise to 230 million within the next 10-12 years.

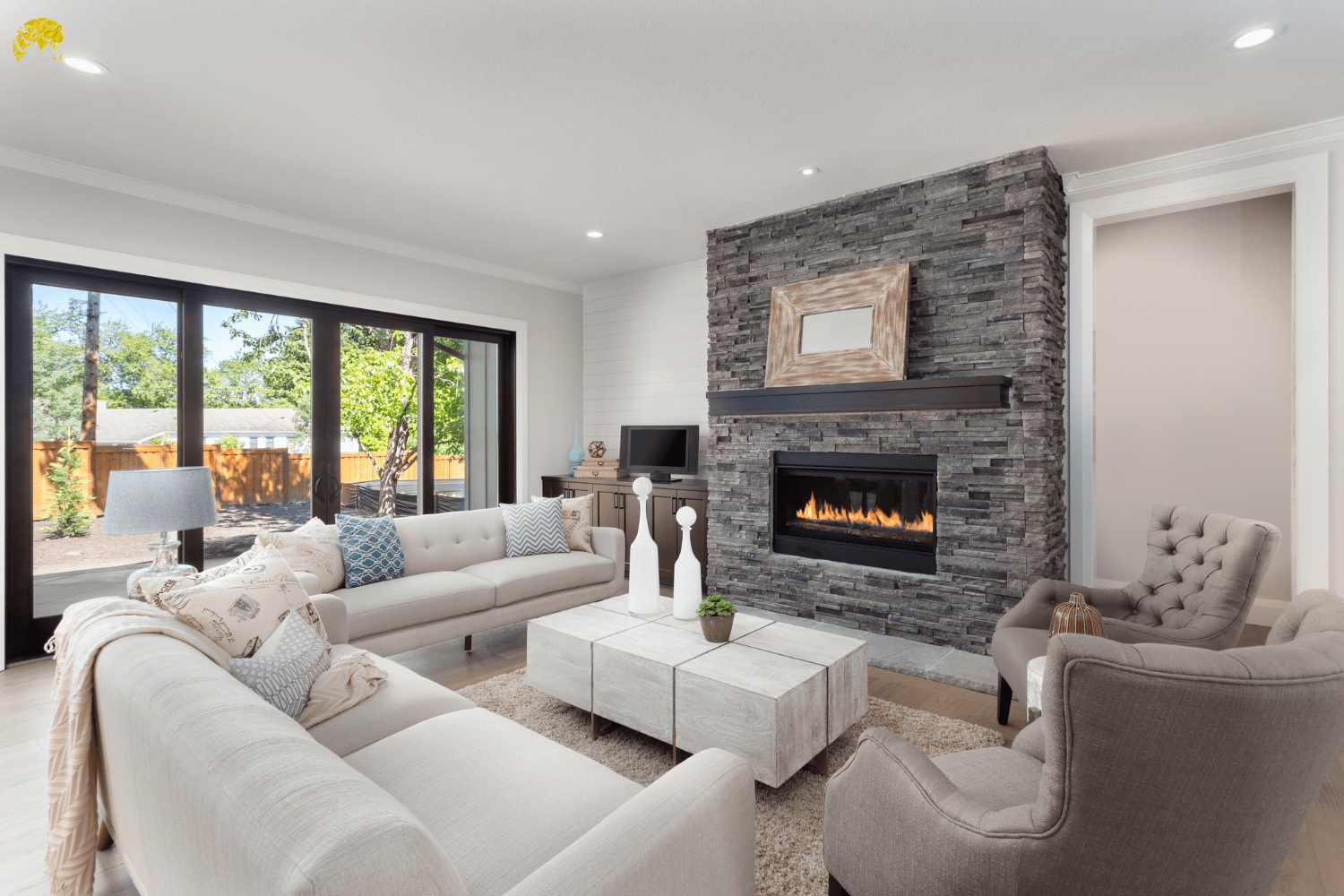

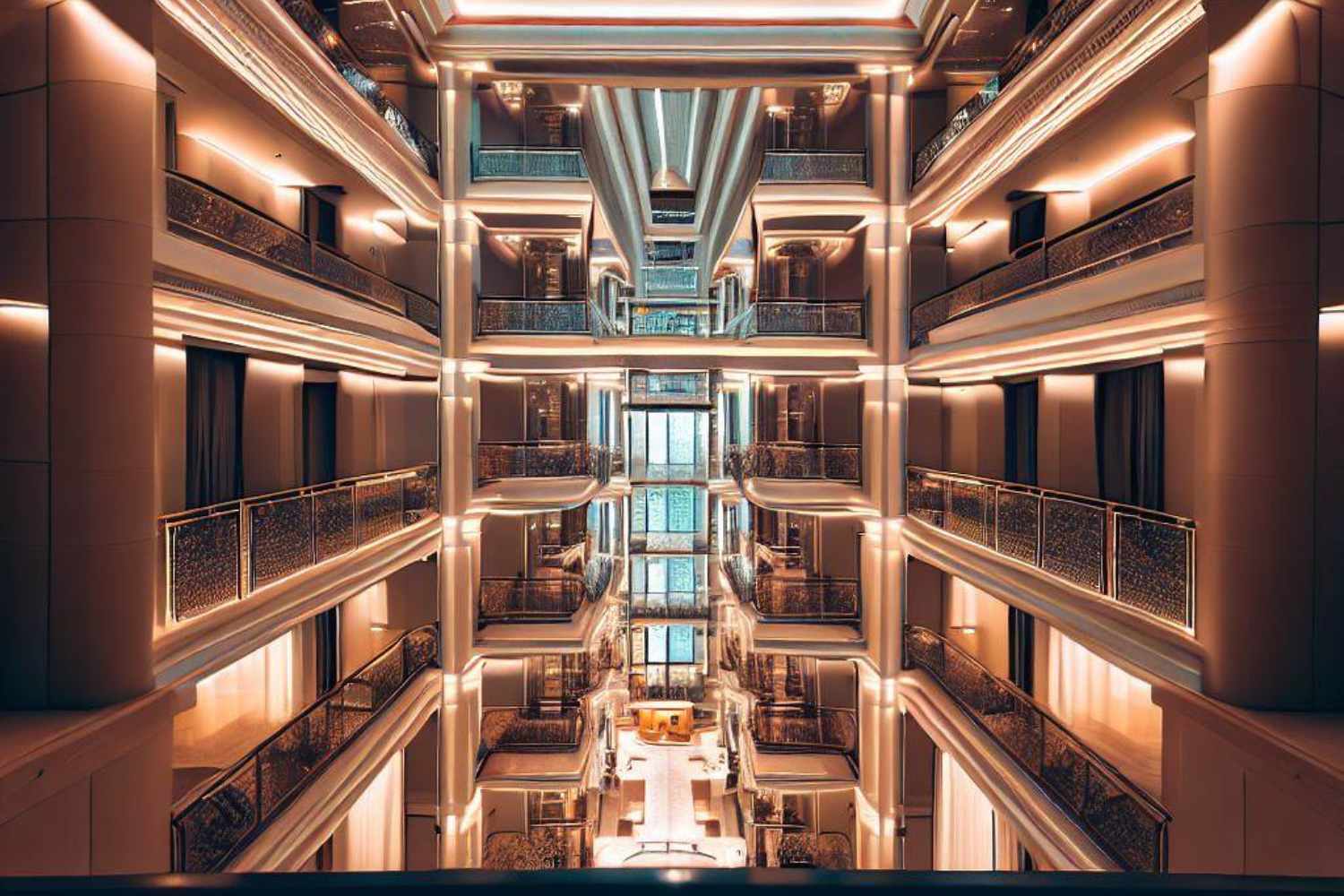

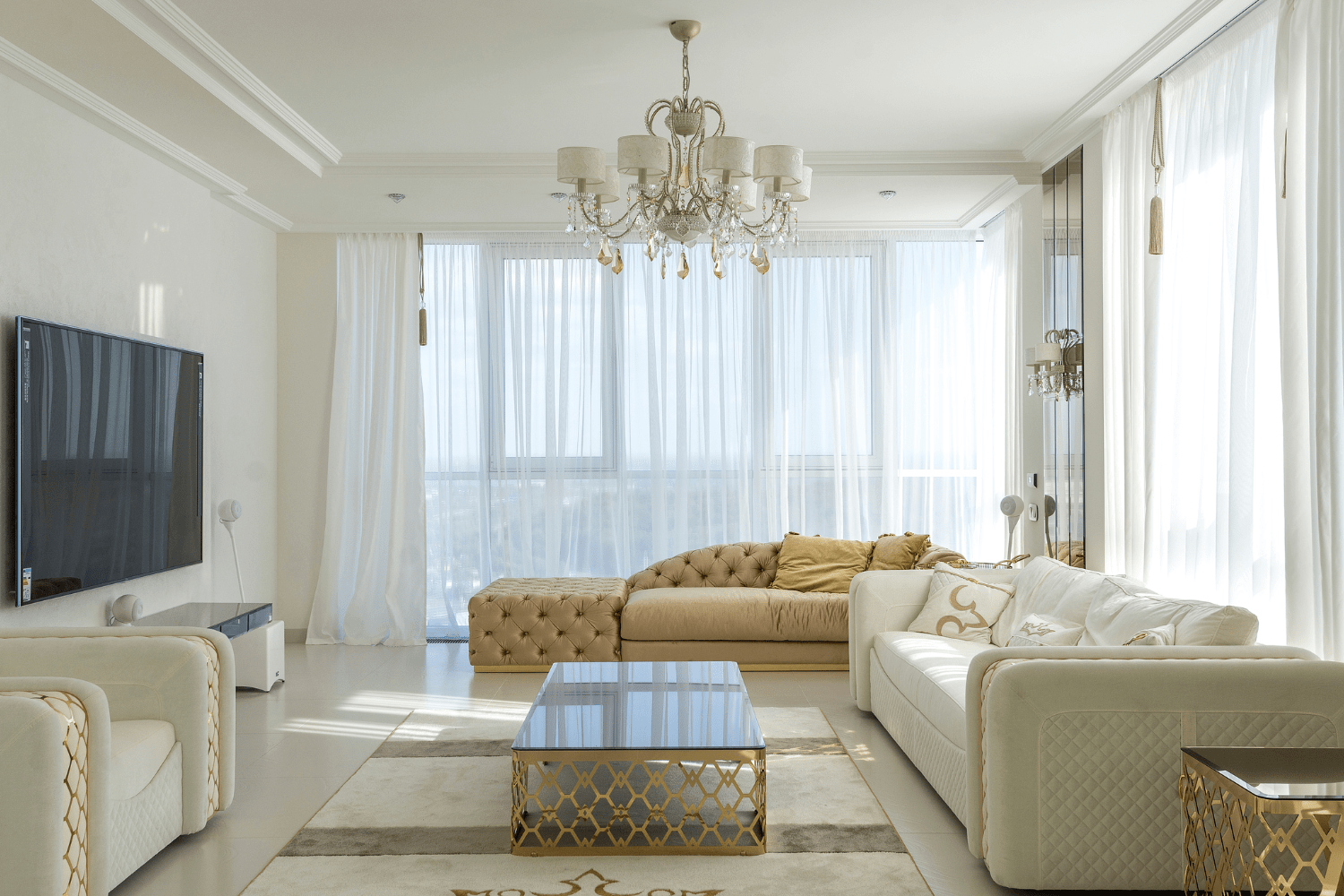

Best Luxury Senior Living in India

https://youtu.be/BsPeTr_gpbw?si=JXNoccTWaz9J8hiP Source: https://www.hindustantimes.com/real-estate/south-indian-states-including-bengaluru-lead-with-62-share-of-the-senior-living-housing-segment-101713518821477.html?utm_source=whatsapp&utm_medium=social&utm_campaign=ht_site