By Opulnz Abode | January 28, 2026 | Read Time: ~6 Minutes

Senior living in Gurugram has become mainstream. DLF Arbour Senior Living in Sector 63 and Max Antara Estate 361 in Sector 36A (Dwarka Expressway) are two leading projects. Both are ultra-premium, though each appeals to distinct buyer profiles.

This comparison covers location, product offerings, developer reputation, pricing, amenities, exit liquidity, and NRI suitability to help you determine which project best aligns with your family’s legacy and financial objectives.

1. Location & Connectivity – The Deciding Factor for Many NRIs

DLF Arbour Senior Living – Sector 63

- Micro-market: Golf Course Extension Road extension (Sohna Road side)

- Distance from signature landmarks: – Medanta Hospital – 12–14 min – Huda City Centre Metro – 18–20 min – IGI Airport – 35–40 min

- Surroundings: Established residential catchment (Golf Course Extension Road, Nirvana Country, Sector 50–65 belt), mature social infrastructure.

Max Antara Estate 361 – Sector 36A

- Micro-market: Dwarka Expressway (CPR link)

- Distance from signature landmarks: – Medanta / Fortis – 18–22 min – IGI Airport – 25–30 min (via fully operational Dwarka Expressway) – Upcoming Global City & Cyber City 2 – 5–10 min

- Surroundings: Emerging high-growth corridor with massive future upside now unlocked by the completed expressway.

Verdict: DLF Arbour Senior Living wins on today’s proven lifestyle ecosystem and shorter drive to existing top hospitals. Max Antara Estate 361 now wins decisively on airport connectivity (25–30 min) and future capital appreciation — the complete opening of Dwarka Expressway has transformed this corridor into a genuine high-speed link to Delhi and the airport.

2. Product & Unit Mix – Space & Privacy

DLF Arbour Senior Living

- Unit mix: 4 BHK + Servant (≈4,000 sq ft)

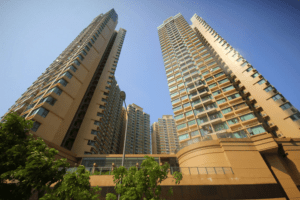

- Towers: 1 tower, 45 floors, 176 units total

- Density: Low density (176 units in a single tower in 5 acres)

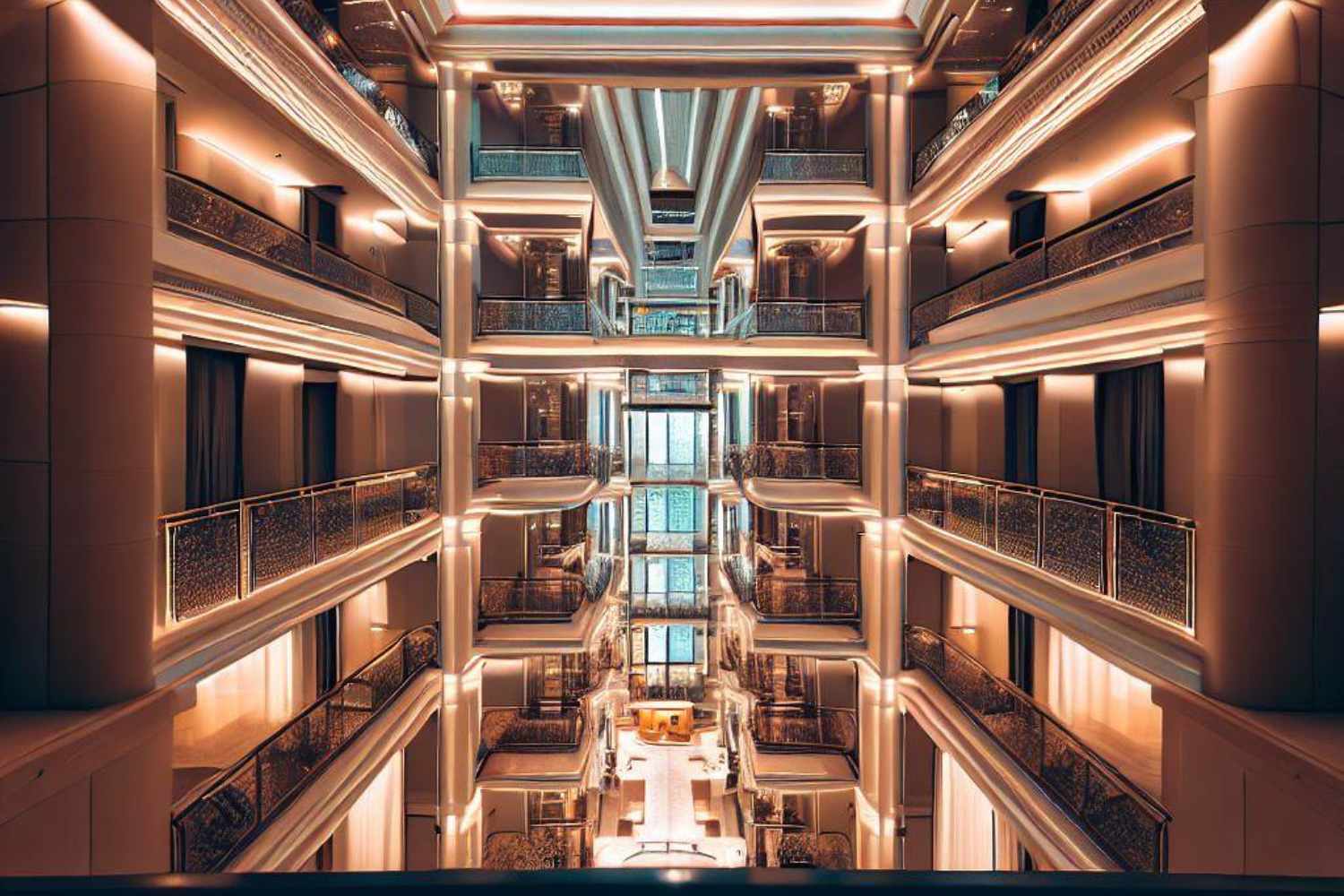

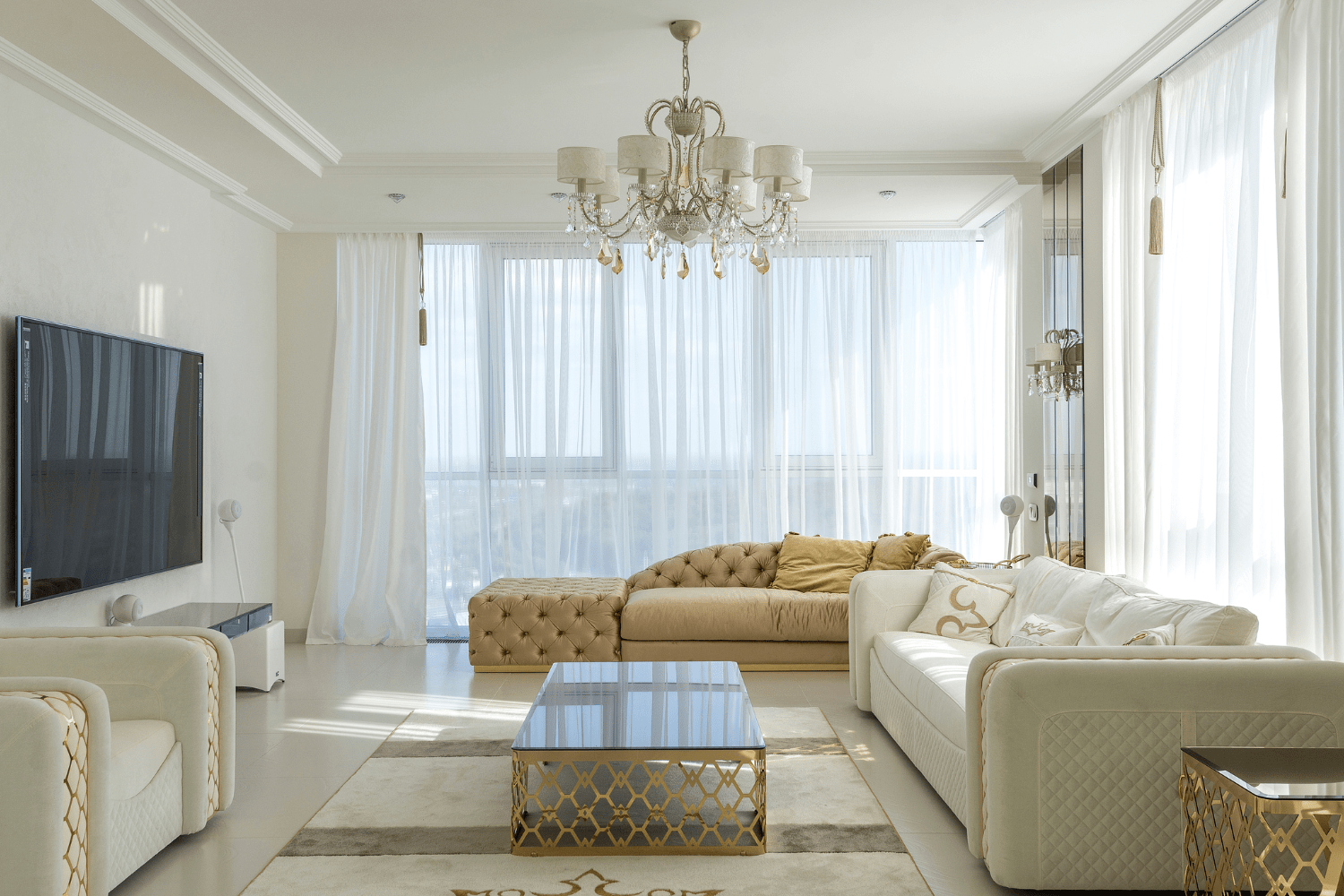

- Design philosophy: DLF’s signature large balconies, high ceilings, and natural light focus

Max Antara Estate 361

- Unit mix: – 2.5 BHK ≈ 2,200 sq ft

- 3 BHK ≈ 2,500 sq ft

- 4 BHK ≈ 3,200 sq ft

- Towers: 2 towers – Likely 45 floors (tallest in the segment)

- Density: Lower effective density due to larger average unit size and fewer units per tower in 18 acres

- Design philosophy: Max Estates’ “wellness-first” approach + larger private outdoor spaces

Verdict: Max Antara Estate 361 provides greater privacy and larger average unit sizes. DLF Arbour Senior Living focuses exclusively on 4-BHK + servant units with a limited number of residences per tower.

3. Pricing & Yield Comparison (NRI Lens)

DLF Arbour Senior Living

- Expected pricing: ≈ ₹30,000 per sq ft carpet

- Estimated rental yield: 4.5–5.5% net (senior living premium + DLF brand)

- Exit liquidity: Very high — DLF resale market is deepest in NCR

Max Antara Estate 361

- Expected pricing: ≈ ₹22,000 per sq ft

- Estimated rental yield: 5.5–6.5% net (lower entry price + senior living premium)

- Exit liquidity: Growing fast, now accelerated by the fully ready Dwarka Expressway

Verdict for NRIs: Max Antara Estate 361 delivers higher entry yields and greater potential for capital appreciation, given the operational Dwarka Expressway. DLF Arbour Senior Living provides stronger exit liquidity and a premium resale value due to its established brand.

4. Developer DNA & Execution Track Record

DLF

- Brand equity: India’s most trusted residential developer (Camellias, Dahlias, Magnolias benchmark)

- Execution: Proven ability to deliver large-scale, high-quality projects on time

- After-sales: Strong, established property management team

Max Estates

- Brand equity: Rapidly rising ultra-premium player (Max Estate 128, Max Square, Max House)

- Execution: Smaller portfolio but impeccable quality and timely delivery

- After-sales: Boutique-level service, very high resident satisfaction scores

Verdict: DLF is preferred for its established trust and proven large-scale execution. Max Estates is favored for its personalized service and contemporary brand appeal among younger HNIs and NRIs.

5. Personalized NRI Advice – SuperLuxere Perspective

For NRIs and overseas family offices, senior living in Gurugram is currently among the most attractive asset classes in India. Our key recommendations are as follows:

- Yield + Appreciation Combo: Max Antara Estate 361 likely offers a 5.5–6.5% net rental yield + 10–14% annual capital appreciation (Dwarka Expressway is now fully ready). DLF Arbour Senior Living likely gives 4.5–5.5% yield + 8–10% appreciation (proven micro-market).

- Currency & Repatriation: Rental income may be repatriated under LRS after tax. Many NRIs use senior living investments as an INR hedge while earning a 5–6% yield in USD terms.

- Tax Efficiency: Long-term capital gains (after 24 months) are taxed at 12.5% with indexation. Rental income is taxed at slab rates, but can be optimized through family trusts or companies.

- Family Peace of Mind: For NRIs with parents in India, 24×7 medical response, concierge services, and community living provide reassurance. Many clients consider this the true return on investment.

- SuperLuxere Access: Through our global network, SuperLuxere clients receive early access to DLF Arbour Senior Living and Max Antara Estate 361 before public launch, priority unit selection, customized payment options, and comprehensive NRI compliance support including RBI, FEMA, and tax filing.

5 Key Takeaways

- DLF Arbour Senior Living (Sector 63) offers 4 BHK + servant ≈4,000 sq ft at ≈₹30,000 psf, 1 tower, 176 units

- Max Antara Estate 361 (Sector 36A) offers 2.5 BHK ≈2,200 sq ft, 3 BHK ≈2,500 sq ft, 4 BHK ≈3,200 sq ft at ≈₹22,000 psf

- Both projects are 45 floors high, but Max Antara provides larger average unit sizes and lower effective density.

- DLF wins on brand trust, exit liquidity, and proven micro-market; Max wins on yield and future appreciation (Dwarka Expressway now fully operational)

- SuperLuxere, a global ultra-luxury brand trusted by HNIs, UHNIs, family offices, and NRIs, views senior living as a high-yield, empathy-driven asset class that delivers both legacy impact and strong financial returns in India and Dubai.

For details on senior living projects in Gurugram or other key micro-markets, please contact Opulnz Abode. We assist global family offices and NRI investors in structuring ultra-luxury, branded residence, and senior living investments across India and Dubai.

DLF Hamilton Court 2 Golf Course Road , Sobha Sector 63A Gurgaon, Max Antara Gurgaon, Oberoi Realty Gurgaon sector 58, DLF Sector 61 Gurgaon, Max Estate 59, Godrej Sector 53 GCR, Kreeva Delhi Project , Max Estate 128 Noida, Max Estate 105 Noida, TARC Kailasa Patel Road Delhi , Trident Realty Sector 104, Experion sector 53 Gurgaon Experion One 42 GCR Central Park Delphine Central Park sector 104 Godrej Connaught One Delhi Max Estate 361 Gurgaon DLF Arbour Senior Living DLF The Dahlias Sobha Rivana Greater Noida AIPL Lake City Rivera Adani The Marq Sector 102, www.superluxere.com www.superluxere.com/blogs/ www.superluxere.com/residentialprojects/ www.superluxere.com/commercialprojects/ www.superluxere.com/cities/ Birla Arika Sector 31 GurgaonSources: https://www.dlf.in/ , https://maxestates.in/