By Opulnz Abode | January 28, 2026 | Read Time: ~5 Minutes

India’s senior living segment is finally seeing serious institutional commitment. DLF Ltd has confirmed it will launch its first dedicated senior living housing project in Gurugram this quarter, with expected revenue potential of approximately ₹2,000 crore. The announcement comes at a time when several large developers are quietly evaluating the segment. Still, DLF’s entry carries symbolic weight — it is the first time one of India’s largest residential developers is publicly committing significant capital to purpose-built retirement housing in the NCR.

DLF’s Gurugram Senior Living Project – First Details

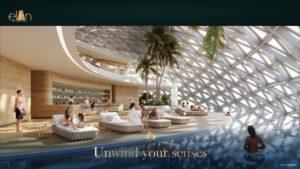

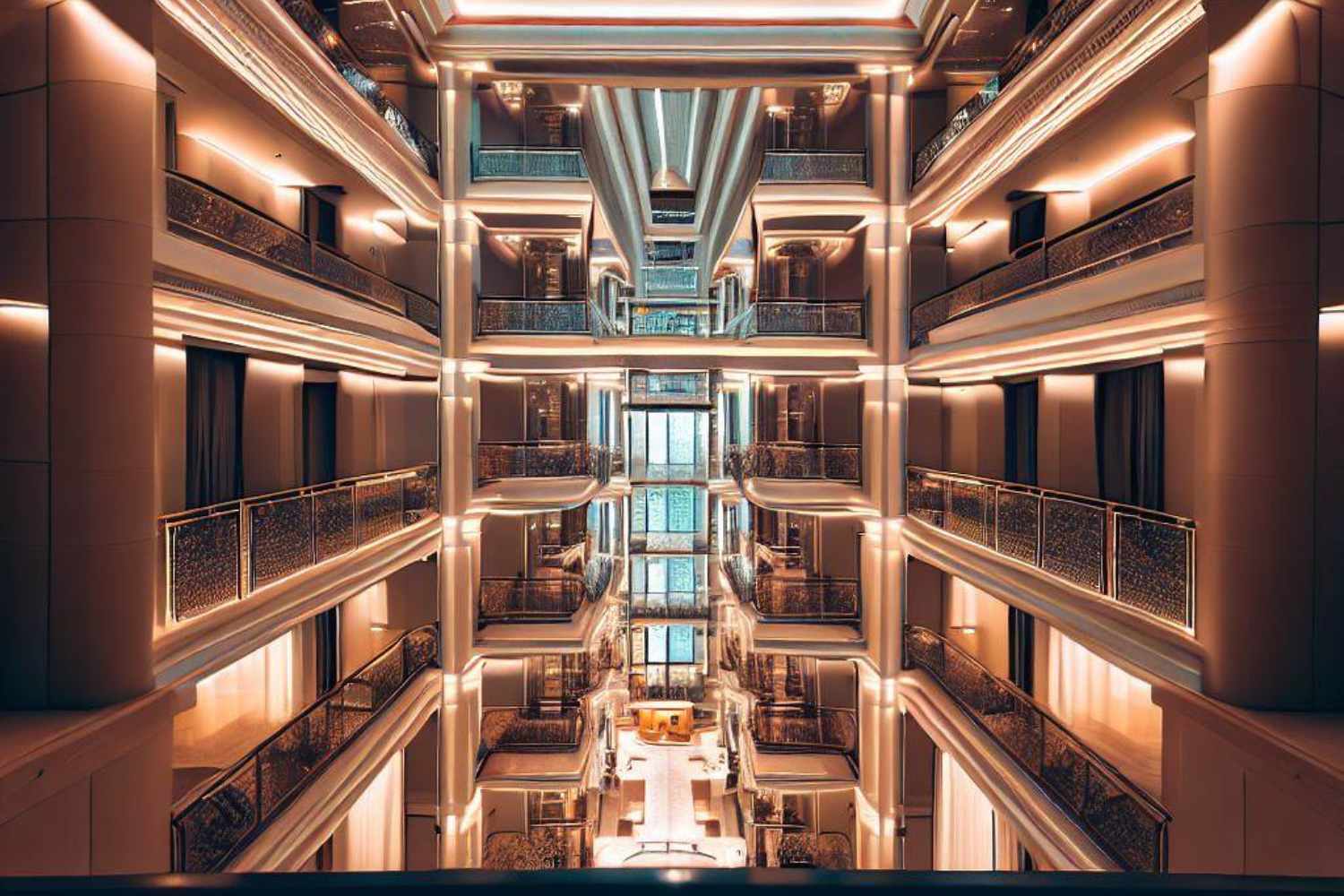

According to Ashok Tyagi, Managing Director, DLF Ltd (during the post-earnings call), the project will be located close to DLF’s existing premium residential developments in Gurugram. While exact location, unit mix and pricing are still under wraps, the company indicated the offering will be positioned at the absolute top end of the senior living spectrum — fully aligned with DLF’s ultra-premium brand DNA.

This will be DLF’s first residential project exclusively tailored for seniors. Industry sources suggest the developer is likely to bring the same level of clubhouse, concierge, wellness, and medical infrastructure that characterises its Camellias/Dahlias-level developments, but re-engineered for the 55+ and 60+ demographics.

Why Gurugram – and Why Now?

Gurugram has quietly become India’s most attractive address for affluent early retirees and empty-nesters:

- Large concentration of financially secure professionals, doctors, bureaucrats and business families

- Children often settle abroad or in other metros.

- Excellent private healthcare ecosystem (Medanta, Fortis, Artemis, CK Birla, etc.)

- Strong lifestyle ecosystem (golf courses, clubs, international schools)

- Proven appetite for high-end community living

Himanshu Bamola of SuperLuxere Investments explains: “Gurugram is a natural market for senior living. Many financially secure individuals are retiring early, children are abroad, and they are consciously choosing independent, well-managed living in their second innings. Rental yields in properly structured senior living can reach 6% — comparable to commercial assets — while Haryana’s policy allows additional development on group housing land without extra density charge.”

SuperLuxeRE — the global ultra-luxury brand trusted by HNIs, UHNIs, family offices and NRIs — has been tracking senior living as a high-yield, empathy-driven asset class since 2023. DLF’s entry is a strong validation signal: when the country’s largest developer by brand value and execution capability decides to build a senior-only project in its strongest micro-market (Gurugram), institutional capital and serious end-user demand cannot be far behind.

SuperLuxere is currently curating select senior living opportunities in Gurugram and Dubai for its global clients, combining rental yield modelling with legacy planning and cross-border structuring.

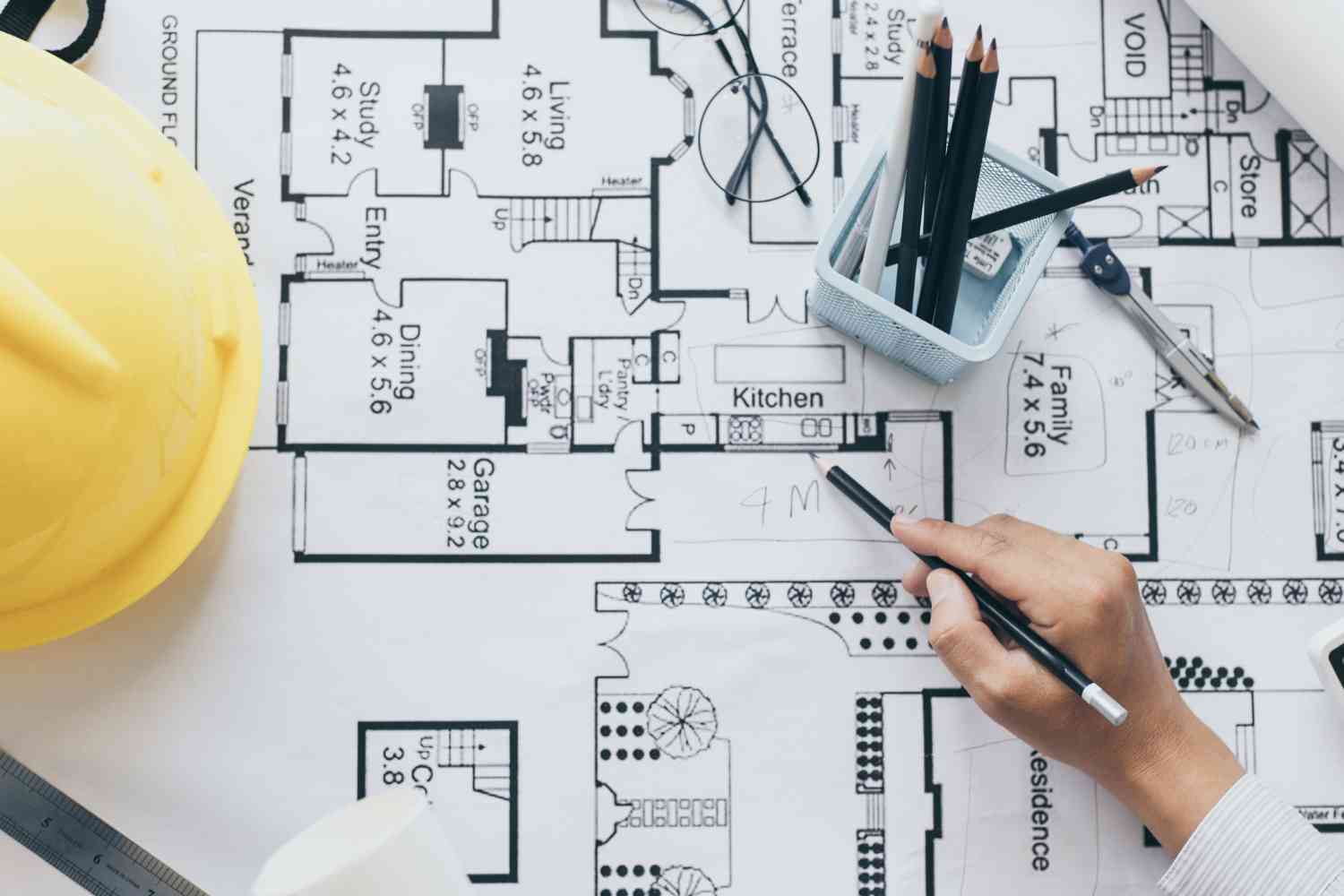

Haryana’s Retirement Homes Policy – The Enabler

Notified in 2021 under the Haryana Development and Regulation of Urban Areas Act, 1975, the policy defines clear standards:

- Minimum carpet area 30 sq m per dwelling unit

- Wheelchair-accessible design (900 mm door openings, sliding windows, easy-grip handles, barrier-free spaces)

- Lifts that accommodate wheelchairs and stretchers with audio-visual signage

- 24×7 on-site ambulance with oxygen support

- Hospital tie-ups and first-aid facilities

- At least one resident per unit must be 60+ (family members can stay temporarily)

The policy has already enabled IGBC Platinum-rated projects such as Pioneer Urban’s Advait in Sector 50 (164 units, ₹300 crore investment, possession early 2027) and J Estates’ three upcoming projects in Sectors 36 Sohna, 63 and 89 (≈450 units, ₹2,100 crore GDV).

https://www.opulnzabode.com/max-antara-gurgaon-senior-living/

DLF’s Broader Context – FY26 Momentum

Despite muted Q3 FY26 sales bookings (₹419 crore vs ₹12,039 crore YoY), DLF reiterated its full-year pre-sales guidance of ₹20,000–22,000 crore. The company attributed the slowdown to:

- Conscious pause in sales at The Dahlias (ultra-luxury project)

- No new residential launches in Q3

Sales at The Dahlias have resumed this quarter with prices up >25% from pre-launch levels (Oct–Dec 2024). Aakash Ohri, MD – DLF Home Developers, confirmed a recent NRI purchase in the project (identity not disclosed).

DLF is also preparing multiple launches later in FY26 across Gurugram, Mumbai, Panchkula and Goa, and continues to scale its annuity portfolio (49 million sq ft) and residential pipeline (280 million sq ft potential).

Why Senior Living Makes Strategic Sense for DLF

- Demographic tailwind: India’s elderly population expected to double by 2050 (UNFPA)

- Changing family structures: nuclear families, children abroad, and desire for independent living.

- Scarcity of organised supply → attractive rental yields (up to 6%)

- Haryana policy incentives → additional development rights on group housing land

- Brand fit → DLF can deliver Camellia ‘s-level quality and service to seniors.

Personalised NRI Advice – SuperLuxere Perspective

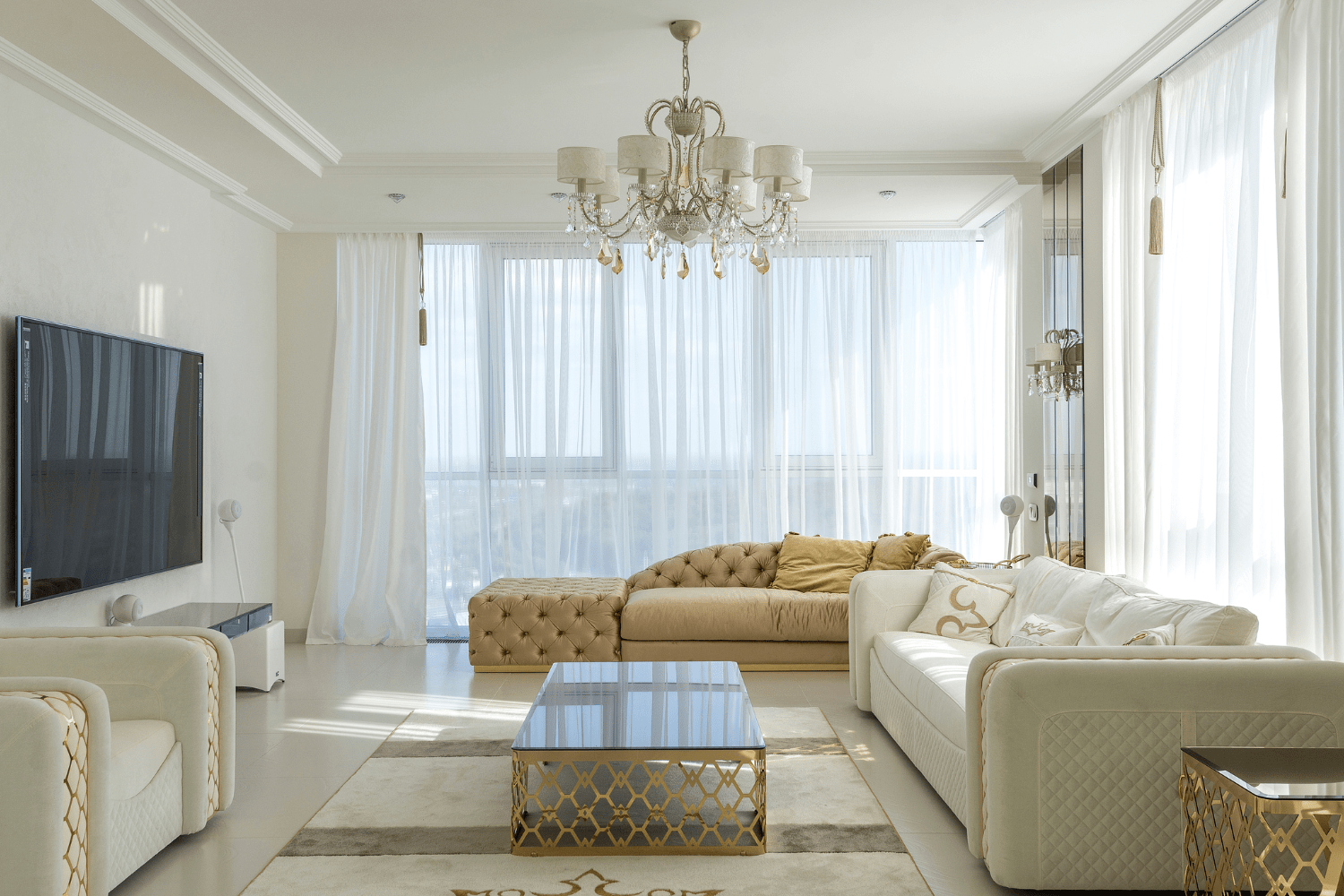

For NRIs and overseas family offices, senior living in Gurugram offers a unique dual benefit: meaningful legacy planning for parents back home + attractive financial returns. Here are the key considerations we share with our NRI clients:

- Rental Yield + Capital Appreciation Properly structured senior living projects in Gurugram can deliver 5.5–6.5% net rental yield + 8–12% annual capital appreciation (conservative estimate based on 2024–2025 micro-market data). This combination often outperforms traditional residential rentals in the same city.

- Currency & Repatriation Advantage Rental income can be repatriated under the Liberalised Remittance Scheme (LRS) after tax. Many of our NRI clients use this as a hedge against INR depreciation while keeping the capital invested in a hard asset.

- Tax Efficiency Long-term capital gains (after 24 months) are taxed at 12.5% with indexation benefit (post-July 2024 budget). Rental income is taxed at slab rates, but many NRIs structure ownership via family trusts or companies to optimise tax.

- Family Peace of Mind For NRIs whose parents are in India, the 24×7 medical response, concierge support and community living reduce worry. Many clients tell us this is the real ROI — knowing parents are safe, engaged and looked after.

- SuperLuxere Access Through our global network, SuperLuxere clients get early access to DLF’s senior living project (before public launch), priority unit selection, customised payment structuring, and end-to-end NRI compliance support (RBI, FEMA, tax filing).

If you are an NRI or family office evaluating senior living as an asset class in India (or branded residences in Dubai), this is the right time to engage. DLF’s entry has de-risked perceptions of the segment — organised supply is coming, and early movers will capture the best yield and appreciation combination.

5 Key Takeaways

- DLF to launch its first dedicated senior living project in Gurugram this quarter (revenue potential ~₹2,000 crore)

- The project will be positioned at the absolute top end, close to DLF’s existing ultra-premium developments.

- Haryana’s 2021 Retirement Homes policy enables higher density and provides clear design & service standards.

- Segment benefits from demographic tailwind, scarcity of organised supply, and attractive rental yields (up to 6%)

- SuperLuxere — the global ultra-luxury brand trusted by HNIs, UHNIs, family offices, and NRIs — sees senior living as a high-yield, empathy-driven asset class that offers both legacy impact and strong financial returns in India and Dubai.

For senior living project details in Gurugram or other key micro-markets, reach out to Opulnz Abode. We work with global family offices and NRI investors to structure ultra-luxury, branded residence and senior living investments across India and Dubai.

DLF Hamilton Court 2 Golf Course Road , Sobha Sector 63A Gurgaon, Max Antara Gurgaon, Oberoi Realty Gurgaon sector 58, DLF Sector 61 Gurgaon, Max Estate 59, Godrej Sector 53 GCR, Kreeva Delhi Project , Max Estate 128 Noida, Max Estate 105 Noida, TARC Kailasa Patel Road Delhi , Trident Realty Sector 104, Experion sector 53 Gurgaon Experion One 42 GCR Central Park Delphine Central Park sector 104 Godrej Connaught One Delhi Max Estate 361 Gurgaon DLF Arbour Senior Living DLF The Dahlias Sobha Rivana Greater Noida AIPL Lake City Rivera Adani The Marq Sector 102, www.superluxere.com www.superluxere.com/blogs/ www.superluxere.com/residentialprojects/ www.superluxere.com/commercialprojects/ www.superluxere.com/cities/ Birla Arika Sector 31 Gurgaon